- Home

- News & Insights

- Industrial Software: Hot or Not?

Industrial Software: Hot or Not?

Sustainable underlying trends, attracting interest from all market participants, coupled with high risks and investments in the development phase are paving the way for a thriving market.

The European M&A market for industrial software continues to be fuelled by consolidation across all end market segments. Ongoing trends of digitalization within the industrial sector, increasing convergence of sectors and the demand for more (factory) automation to counteract the increasing shortage of talent are just a few selected trends contributing to the growing interest from private equity firms and strategic players crossing sector and geographic borders.

Software as a solution to competition gaps

The advancement of Industry 4.0 implementation, integrating digital technologies into the manufacturing process, positions digitalization at the core of most sectors. Compliance with this trend has become inevitable for companies striving to stay at the forefront of innovation. Both micro- and macroeconomic trends, such as skilled labor shortages, ESG policies, and reshoring of complete production plants, are accelerating this process. Meanwhile, safeguarding assets is essential as the industrial system becomes more (cyber)connected and online. The German industry, accounting for approximately 25% of the country’s GDP, is considered critical infrastructure, emphasizing the need to ensure data integrity.

Market interest from different strategic angles

Software has always attracted various buyer pools with different strategic interests. Financial sponsors are particularly interested in recurring and scalable revenues combined with high-profit margins. In contrast, strategic players seek capabilities expansion and the “softwarization“ of their hardware (IoT). The industrial software market demonstrates sustainable growth underpinnings, with optimizing and modernizing the IT landscape being more crucial than the hardware itself.

Deal examples:

Growth capital unlocked for Desk by Software Partners Group

“SPG is a partner that combines excellent technology know-how and buy & build expertise, which will enable us to reach the next stage of our buy&build journey.” Volker Schneider (CEO, Desk)

wenglor sensoric group acquires Berlin based AI and Image processing Start-Up deevio

“With the acquisition of deevio GmbH, we have this opportunity to further strengthen our expertise and capability in the field of machine vision. In recent years, deevio has developed a great deal of know-how in using AI and data science for image processing applications within the automation industry, which is a considerable advantage for us.” Rafael Baur (Managing Director, wenglor)

Data (analytics) driven production: The new standard

New levels of data accessibility have been achieved, with standard APIs implemented across the entire IT landscape of the industry and collaboration between industrial technology providers. Data lakes are formed through a multi-sourcing policy from (digital twin) machinery and sensors, the IT architecture (ERP, MES, etc.), and human-generated data (quality management, observations, etc.). Recent technologies, such as AI, cloud computing, and predictive models, enable the treatment and analysis of the vast amount of generated data. Decision-makers now have access to aggregated and qualitative information for data-driven decisions.

Deal examples:

Majority investment of FSN Capital in Lobster

“In a world of exponentially growing amounts of data, complexity of data flows and application stacks, Lobster offers easy to use, economic and powerful software solutions to integrate data, applications, and processes of all forms and variations.” Robin Mürer (Co-Managing Partner, FSN Capital Partners)

The same old challenge… – make or buy

The ultimate question in growth strategies making companies consider M&A as an option is whether to make or buy. The combination of high development costs (in time and opportunity) but risky success rates is the primary rationale for market activity within (industrial) software to expand its capabilities and/or geographical footprint. The principle of Moore’s Law is still true in today’s technology ecosystem. Rapid cycles leave no room to develop everything in-house, acting as a catalyst for market activity.

Deal examples:

“Best Practice IT Solutions’ cloud-based software will complement Aptean’s current Food & Beverage ERP offering and enhance our ability to serve beverage companies.” Duane George (GM, Aptean)

“By bundling the expertise of tisoware and Persis, we create a uniquely comprehensive HR ecosystem for our customers. Together with solutions for access and building security (Security) and for optimizing production processes (MES) in the context of Industry 4.0, we offer an overall workforce portfolio for medium-sized enterprises in the DACH region.” Markus Steinberger (CEO, tisoware)

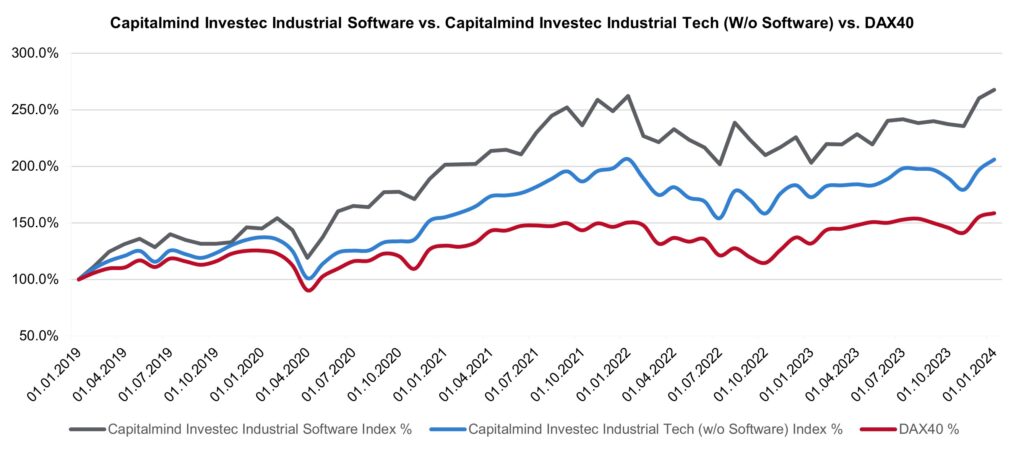

Our industrial software index outruns other indexes

Since 2019, the Industrial Software Index has risen almost threefold, while the main Industrial Technology sector has doubled. A new all-time high has been reached for market capitalization.

The main macroeconomic events over the last 5 years have similarly impacted all indexes, but industrial software market capitalizations seem to recover more quickly.

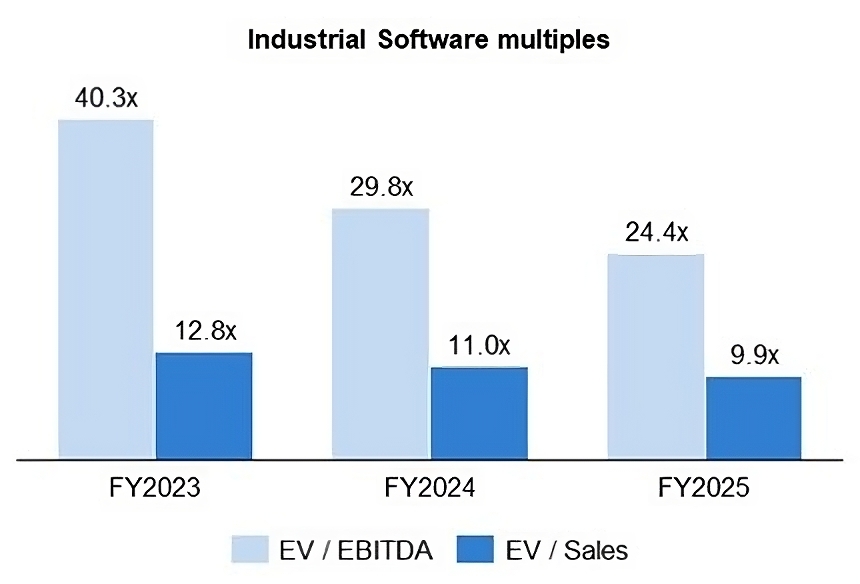

Valuations for listed industrial software companies, both EV/EBITDA and EV/Sales, remain high, with forward multiples at ca. 11x sales FY2024.

So, industrial software – hot or not?

Most checkboxes are ticked for answering the question positively:

- High valuations are fueling market activity.

- Growing interest, both from financial investors and large software consolidators.

- Sustainable market movers, with both strategic and financial rationale, are dictating most transactions.

Capitalmind Investec Industrial Technology

The Capitalmind Investec Industrial Technology index tracks daily developments in sectors such as Flow & Process Control, Robots/Motion, Electronics/Control / Connect, Integrated providers, Measurement/Vision Tech, Industrial Software, Intralogistics/System integration and Machinery.

The index includes valuations, growth projections, profitability margins and other metrics.

Would you like to learn more about valuations, buyer activity and current opportunities in the market?

Please do not hesitate to contact us.

You can find more information on our website at Industrials | Capitalmind Investec