Market snapshot

Current developments on the Schuldschein market

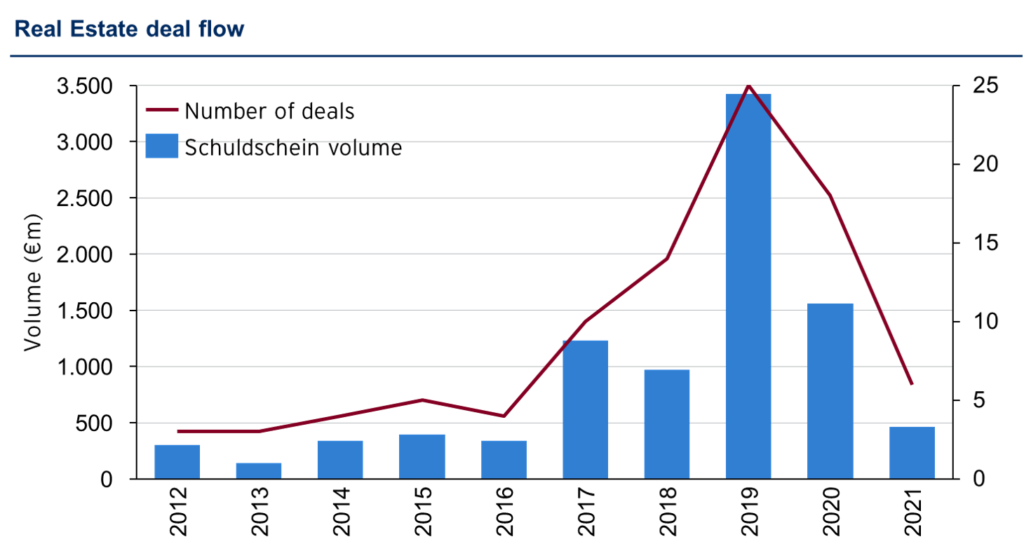

- The Schuldscheinmarket is recovering much more slowly from corona impacts than the bond market. In H1 2021 deal volume are is still 51% below H1 2019

- International issuers return to the market, despite two-thirds of deals still from Germany

- Corporate Schuldschein issuance decreased 6% in the first nine months of 2021 with €11.97 billion of volume when compared to the first nine months of 2020 which saw €12.76 billion of issuance

- A total of 81 deals were completed in the first nine months of 2021, up from 77 deals completed in the first nine months of 2020.

Schuldschein activity – Spotlight selected Real Estate

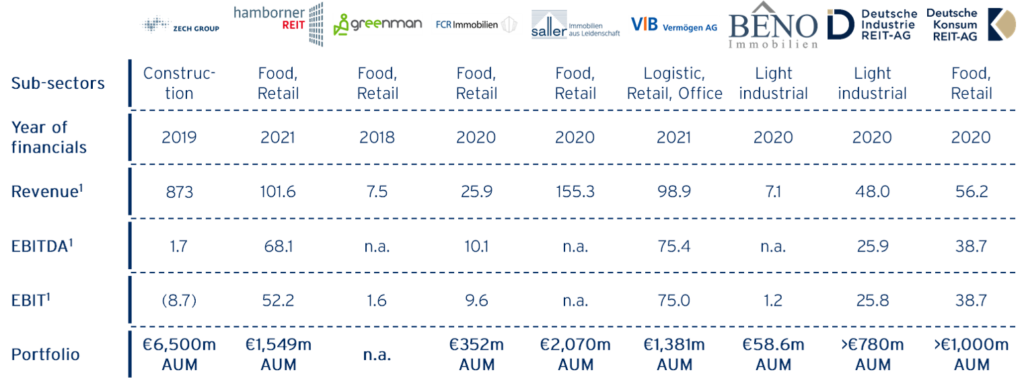

- Zech Group is a frequent issuer with relationship banks and selected international partner banks

- Hamborner REIT well comparable peer, however, no Schuldschein post COVID placed

- Greenman has a complex structure, therefore no placed volume/deal

- FCR Immobilien public bond coupon 4.25%, 5 years maturity

- Noratis AG residential portfolio developer, 4.75% yield, 6 years maturity, EUR 10m private placement

Capitalmind Investec has developed strong expertise in succession planning for entrepreneurs by supporting numerous financing, acquisition and divestment projects for family businesses. If you would like to discuss financing solutions for your business, please do not hesitate to contact us.