The Testing, Inspection & Certification (TIC) sector is in robust shape, judging from discussions at Capitalmind Investec’s second annual European TIC Conference (March 2024). Personal experiences shared by the heads of two highly acquisitive TIC businesses offered the audience of 60 industry leaders valuable insights into current Mergers and Aquisitions (M&A) thinking and trends.

The event kicked off with an overview of the state of the M&A market in the TIC sector. Capitalmind Investec has built up many years’ experience providing mid-market TIC companies in the UK, Europe and US with M&A financial advice.

Marleen Vermeer, Partner at Capitalmind Investec, highlighted the growing shift towards a global focus in M&A activity. “Until a few years ago, TIC M&A activity was generally domestically oriented. That is now changing quite rapidly with more cross-border transactions,” she said.

Watch and read the highlights from our European TIC conference

Acquisitions and organic growth

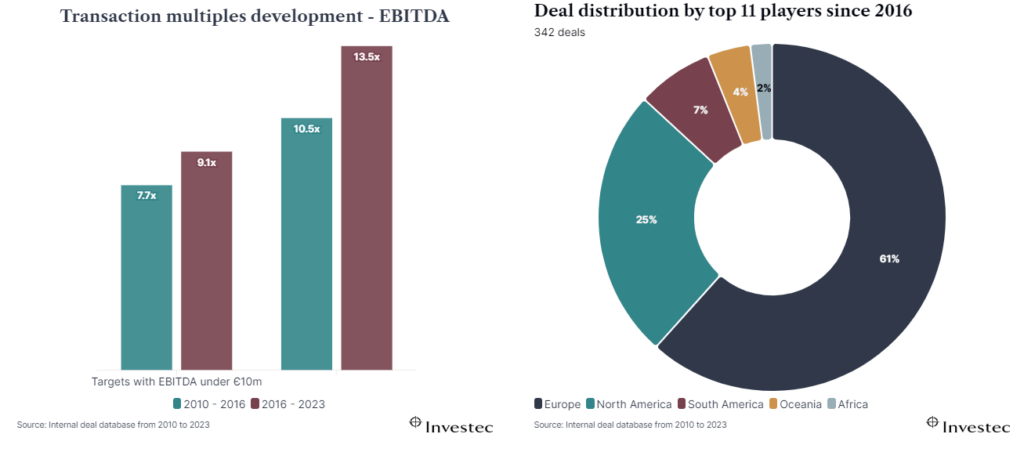

Higher levels of M&A activity than is generally seen in the market are being supported by stable company valuations and high exit EBITDA multiples, as Michel Degryck, Managing Partner at Capitalmind Investec, explained: “We saw a rise in valuations from 2020 to 2022 and they are now more stable. Investors are increasingly paying close attention to organic growth in TIC businesses. Generally speaking, a good valuation multiple requires double-digit organic growth. Companies must also demonstrate that their acquisitions can grow fast to prove they will generate value on top of providing relative multiples.”

Continued consolidation trends, with valuation expansion

In the current economic climate, trade buyers of TIC companies are also keeping a keen eye on pricing power. “The ability to pass through inflation cost by increasing prices is important to potential buyers. Businesses that offer more than just pure TIC services tend to succeed better in passing on higher costs,” Michel noted.

Sustainability, digitalisation and internationalisation

Marleen outlined three important trends in the sector: sustainability, digitalisation and internationalisation. “Investors are looking for sustainability and TIC companies are benefiting from growing societal expectations for a safer, more sustainable world,” she observed. Capitalmind Investec predicts that digitalisation, particularly connected devices and remote services, is changing TIC businesses, said Michel: “TIC companies are looking at how they collect and leverage data, and at using artificial intelligence, to provide their clients with more business value. As a result, TIC companies are moving from ticking boxes to check compliance with regulations to providing risk management solutions and business performance tools.”

Internationalisation was evident in the success stories recounted by France-based Trescal, the global leader in calibration with a busy buy-and-build investment strategy, and Netherlands-based Normec, a rapidly growing TIC company.

Until a few years ago, TIC M&A activity was generally domestically oriented. That is now changing quite rapidly with more cross-border transactions.

Marleen Vermeer, Partner at Capitalmind Investec

Trescal: don’t rush acquisitions

Guillaume Caroit, CEO of Trescal, said around one-quarter of annual turnover growth came from organic growth and the rest through acquisitions. Impressive expansion into 30 countries, with over 5,000 staff and 70,000 global customers is the result of combining caution with ambition.

Guillaume’s advice for an effective M&A strategy is “Don’t bite off more than you can chew. And don’t rush things too much.”

M&A activity helps Trescal to maintain its preferred balance between end-markets as well as diversifying into new geographies. Guillaume said private equity firms were supportive of the strategy. “PE firms like the purity of Trescal as a pure player in calibration which is our core business, plus our ability to attract good managers, especially in new countries.”

Chief among his priorities when integrating businesses is to invest in people. The Trescal Institute supports the retention of skilled technicians and engineers post-acquisition by offering training programmes. “Many of our competitors can’t afford to invest as much as us on people,” said Guillaume. “We train people centrally in Paris and recruit locally around the world.”

Normec: focus on countries and sectors

Joep Bruins, CEO of Normec, set up the company in 2015 and immediately began buying small TIC companies. Normec focuses on only four TIC sectors: food, life safety, sustainability and healthcare. About half of its business comes from acquired companies.

“We have a one-stop delivery model for clients to access all types of labs to meet their needs,” he said. “We also offer label compliance and software development services, so they can receive everything from a single supplier.”

Normec’s organic growth is over 10% and it has made over 60 acquisitions to date. This buy & build strategy has been funded by private equity funds since around 2017.

The company’s geographic spread is currently nine countries. “We try to stay as focused as possible in our core sectors and countries,” said Joep. “Our clients are relatively small and many don’t necessarily need international services. Three-quarters of our revenue comes from small- to medium-sized businesses.”

Once a target is acquired, Normec doesn’t look to relocate or centralise the business. “We keep acquired companies where they are, so we have local labs offering high service levels. It’s fairly easy to integrate them into our wider network. Here, colleagues can learn from each other.”

TIC talking points

To round off the conference, Ed Thomas, Managing Director, UK, at Investec, quizzed Guillaume and Joep, along with Charles Welham, a Partner at asset fund management group Bridgepoint, on how TIC M&A activity is changing.

What are the challenges of internationalisation?

Scaling up activities should be a priority, said Charles: “You shouldn’t look at internationalisation for the sake of it. You need to have in place a team that can scale up in different countries, and this gives you a local presence if things go wrong. It helps to focus on just part of the TIC market, rather than buying everything that’s going.”

Joep emphasised understanding the culture and looking for similarities in acquisition targets. “For me, differences between countries are not as big as differences between individual people. Scaling your business as you acquire is as much a question for your Human Resources as your M&A team.”

Guillaume agreed that a personalised approach is essential. “We do the basics and get a cultural understanding of new countries, like Thailand and China. The calibration sector is so niche that target companies probably know us already, which helps.”

What lessons have you learned?

Having a regionally based group structure is important for Trescal. “Previously everyone reported to me; now we have four regional areas with their own P&L reports and steering committees. It helps us manage local issues more effectively,” said Guillaume.

Maintaining a strong local presence is something Bridgepoint learned the hard way. “Local people often want to speak with local deal originators. We’ve gone wrong on larger deals in new countries by not having done enough commercial due diligence or understanding national regulatory changes,” said Charles.

Organic growth or M&A?

Both Joep and Guillaume highlighted the difficulty of ‘doing it yourself’. Joep said: “Organic growth is very hard. For a start, your labs need to be accredited as well as every test you conduct. That can take one or two years. If you want to grow quickly and scale a business, then M&A is a better way.”

Guillaume agreed: “Creating a ‘green field’ operation takes too long. We have opened a number of our own labs in the last 20 years and ended up shutting most of them down.”

What’s your outlook for TIC M&A?

“Trescal is looking to grow in the Asia-Pacific region and has its eye on China, India and Japan” said Guillaume.

For Joep at Normec, it’s a question of “keeping on doing what we’re doing.”

Bridgepoint expects M&A activity to continue at pace. “There are so many acquisition opportunities in the TIC sector. It’s a true technical sell, which is why we like it so much,” said Charles.

The panel also fielded audience questions on rebranding acquired companies, typical deal execution timeframes, how to support target companies that are not yet investor-ready, and the trend towards consolidation in the TIC market.

Interview

As we enter 2024, the M&A landscape shows signs of recovery, albeit cautiously.

In the episode of the February 20, 2024 of No Ordinary Wednesday, Jeremy Maggs in conversation with Capitalmind Investec experts Jürgen Schwarz, Marleen Vermeer, and Kilian de Gourcuff, Investec’s Head of Cross-Border Finance and International Advisory Charles Barlow, on what key sectors, trends and risks to keep an eye on in 2024.

Click here to listen to the podcast:

Where does opportunity lie for dealmaking in 2024? (investec.com)

Hosted by seasoned broadcaster, Jeremy Maggs, the No Ordinary Wednesday podcast unpacks the latest economic, business and political news in South Africa, with an all-star cast of investment and wealth managers, economists and financial planners from Investec. Listen in every second Wednesday for an in-depth look at what’s moving markets, shaping the economy, and changing the game for your wallet and your business.

Listen to the best of No Ordinary Wednesday: https://www.investec.com/en_za/focus/no-ordinary-wednesday-with-jeremy-maggs.html

Sharp decline in demand on the SSD market in 2023?

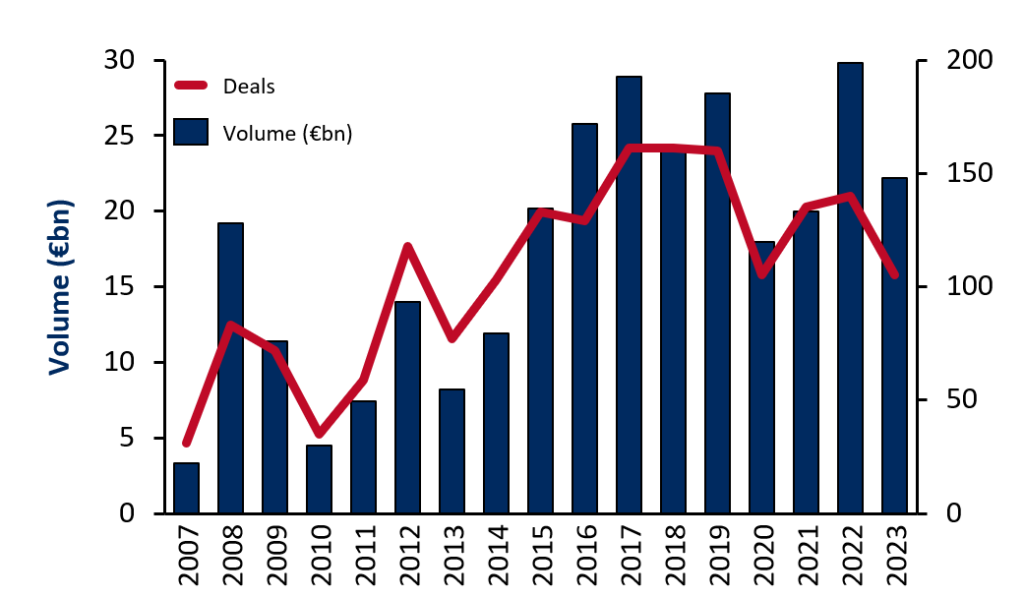

Over the course of 2023, the issue volume decreased by 34%, but still reached a considerable EUR 22.2bn, while the number of transactions fell by 34% to 105. In the record year 2022, the SSD issuance volume had reached an impressive EUR 29.8bn. Interestingly, last year’s total exceeded the average value of the previous ten years by 7%.

View of the SSD market in 2023

In 2023, the market for corporate Promissory note loans (SSD) normalized following the record performance in the previous year, and this trend continued in the fourth quarter. Activity in the SSD market remained robust overall despite a challenging environment in 2023, driven by stable investor demand. Large corporates with external investment grade ratings showed significantly lower participation in the SSD market with 12 transactions compared to the 33 transactions in 2022. From the second quarter of 2023, they tended to increasingly utilize the more competitive bond market, resulting in a lower foreign share compared to the previous year. In addition, fewer debut transactions were recorded in 2023, although some significant transactions by new companies on the SSD market underlined the positive response from investors. At the same time, the market leaves enough room for individualized regulations in the individual companies.

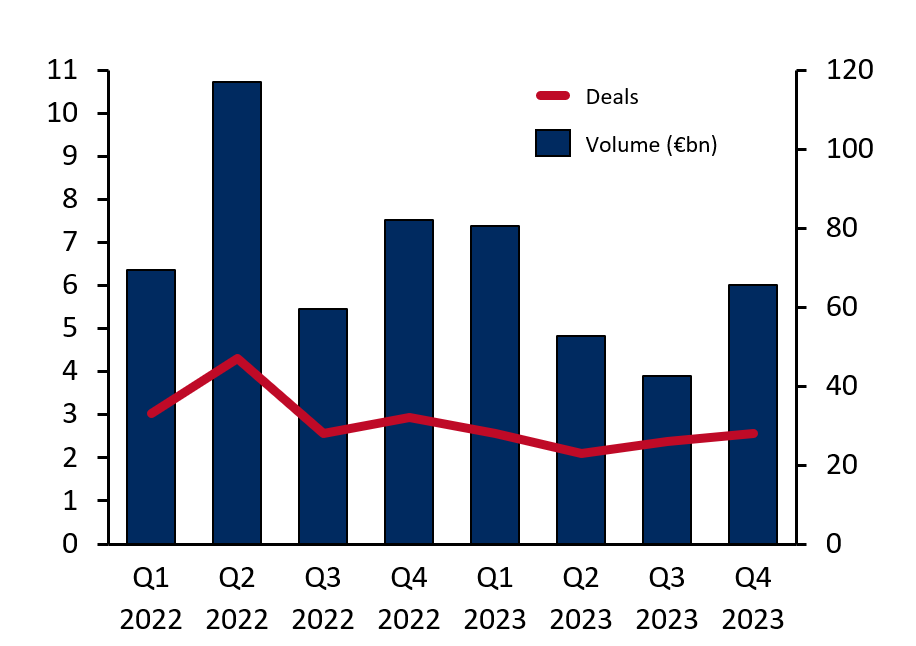

Analysis Q4-Volume

In the fourth quarter of 2023, the SSD market recorded a new volume of around EUR 6 billion, based on valuations. This represents a decline of 25% compared to the record quarter of 2022 with EUR 7.5 billion. At the same time, the number of transactions fell to 28 new SSDs, which also represents a year-on-year decline of 14%.

Compared to the fourth quarters of the past ten years (2013 to 2022), the volume in the final quarter of 2023 was around 16 % below average, both in terms of volume and the number of transactions. Historically, Q2 and Q4 2022 clearly stand out with high volumes.

Click here to download the full report

2023 est un bon millésime pour Capitalmind Investec, et tout particulièrement pour notre bureau parisien qui a réalisé 20% de transactions de plus qu’en 2022, après avoir doublé de taille entre 2019 et 2022 !

Nous profitons de cette période des vœux pour remercier chaleureusement nos clients pour leur confiance et leur fidélité. Nous sommes fiers de nous mettre à leur service pour leur permettre de réaliser leurs ambitions de croissance, en organisant leur capital, en réunissant les financements, et en réalisant des opérations de cessions et d’acquisitions cohérentes tout en associant leurs équipes au succès.

2023 marque une nouvelle étape pour Capitalmind, devenu Capitalmind Investec en juin dernier. Notre rapprochement avec la banque Investec ouvre de belles perspectives de croissance et nous permet de continuer à inscrire notre projet dans la durée et à investir dans notre développement. Investec a pour signature « Out of the Ordinary« . Un appel à cultiver nos différences, à penser “out of the box« , à affirmer nos valeurs et à faire grandir nos talents !

2024 sera une grande année, où nous aurons la joie de fêter nos 25 ans, avec nos équipes, nos clients et nos partenaires ! Ce sera également une année de nouveaux challenges dans un marché de la transaction en forte transformation. Une nouvelle occasion de s’adapter, de se réinventer et de mettre en œuvre des solutions pour permettre à nos clients d’entreprendre et de réaliser leurs projets.

Nous vous souhaitons une très belle année 2024 !

Michel Degryck

Managing Partner – Capitalmind Investec

Sélection d’opérations accompagnées en 2023

Et bien d’autres à découvrir ici…

Success Story : Retours croisés

Depuis 25 ans, Capitalmind Investec accompagne l’ensemble des intervenants du marché des fusions-acquisitions et du financement mid-market. Découvrez leurs témoignages en vidéos :

Cession d’Amendis à Terrial

Anthony Baudoin, Associé de Motion Equity Partners et Thibault Laroche-Joubert, Associé Capitalmind Investec, reviennent dans une courte vidéo sur cette cession.

Acquisition de la société IXBlue

Raphaël Gorgé, Président du Groupe Gorgé et Michel Degryck, Managing partner de Capitalmind Investec, reviennent sur les étapes clés de cette acquisition.

Transmission du groupe Tournaire

Luc Tournaire, Président du Groupe Tournaire et Nicolas Balon, Associé Capitalmind Investec, reviennent sur le process de cette transaction.

Cession d’Icar-Datafirst par Argos Wityu

Karel Kroupa, Managing Partner d’Argos Wityu, et Jean-Arthur Dattée, Associé Capitalmind Investec, reviennent sur l’aventure de cette transaction.

Nominations 2023

Septième associé pour Capitalmind Investec en France : cooptation de Guillaume ten Have

Nomination de Christopher Martin en tant que Directeur

Rapprochement avec la banque Investec

Capitalmind se rapproche de la banque Investec pour créer un acteur mondial du conseil en fusions-acquisitions dédié au mid-market donnant naissance à Capitalmind Investec. Voir plus

Notre équipe reste à votre disposition pour toute question

Financial restructuring for Shareholders & Lenders

Helping clients to navigate uncertainties while putting their businesses back on track

Interview with Jürgen Schwarz, Managing Partner of Capitalmind Investec about Restructuring with the help of a M&A process:

- How did the market change in recent years?

- What is your approach?

- Giving an example

This video answers these questions and give you an idea and overview in a few minutes.

Sale from insolvency

Due to our pan-European presence and track record we are well placed to advise on international and cross-border restructurings.

Our international sector teams implement more than 50 transactions p.a. and in many sectors they know the active buyers, the acquisition criteria, the behaviour of individual decision makers. We also have an up-to-date overview of the market prices paid, which vary considerably over time and depending on the positioning in the sector.

Capitalmind Investec has direct access to numerous international equity and debt capital providers and has carried out numerous restructurings ranging from approximately 10 million Euros to several billion Euros.

A propos du deal

Restructuration et prolongation de sa transaction BEE (Black Economic Empowerment) initiale et introduction d’un plan d’actionnariat salarié.

Investec Bank a assisté Reunert Ltd dans la restructuration et la prolongation de sa transaction BEE initiale et dans l’introduction d’un plan d’actionnariat salarié.

Investec Bank a assisté Reunert Ltd dans la restructuration et la prolongation de sa transaction BEE initiale et dans l’introduction d’un plan d’actionnariat salarié. Par cette transaction, Reunert offrira à ses employés qualifiés la possibilité de participer à la valorisation de Reunert, renforçant ainsi l’alignement de leurs intérêts économiques sur ceux des autres partenaires de Reunert et le succès futur de Reunert. La société continuera également à aider les jeunes femmes de couleur noire par l’intermédiaire du Rebatona Educational Trust. Au total, le Rebatona Educational Trust et le fonds d’actionnariat salarié détiendront dans les faits environ 13 % des actions de Reunert.

A propos de Reunert Ltd

Reunert comprend un portefeuille diversifié d’activités dans trois secteurs principaux : l’ingénierie électrique, les technologies de l’information et de la communication et l’électronique intégrée. Elle détient un portefeuille de marques sud-africaines réputées et respectées, dont CBI-electric, Nashua et Reutech. Reunert s’est engagée à soutenir les initiatives BEE de l’Afrique du Sud et a réussi, au fil des ans, à faire entrer des Noirs dans l’actionnariat d’un grand nombre de ses sociétés opérationnelles.

Minority investments on the rise in the short-run as private companies seek funding to overcome the COVID-19 crisis

The COVID-19 liquidity gap

The financial impact of the sudden COVID-19 pandemic is already severe in many businesses facing extremely low or no activity at all. Naturally, this will quickly lead to a liquidity shortage. As the full economic impact of the current global COVID-19 outbreak remains unpredictable, governments place their trust in aggressive fiscal and monetary policies as well as flexibility from the established banking system.

However, in many cases this is likely to prove insufficient:

- Businesses are already facing short-term liquidity issues, and the length of the crisis remains highly uncertain. Financial planning is close to impossible.

- Government support packages help in the very short-term, but only partly.

- The banking system is rigid and scared of the last financial crises. They will be reluctant towards more exposure, also due to rapidly increasing debt-to-EBITDA levels as a result of lower business activity.

- Even if the strategy will help companies survive, in many cases the businesses will still be forced to cut back investments for several years to recover and regain the same financial strength.

Therefore, many business owners need to search for more flexible solutions to maintain their position on the market towards suppliers, customers, employees, etc.

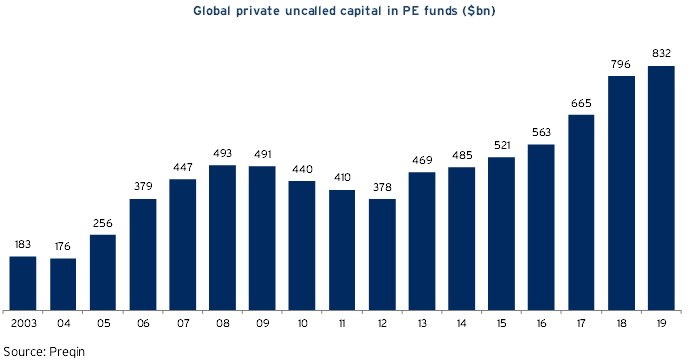

Private Equity funds are piling up cash

Private Equity firms provide flexible funding solutions and have all-time high levels of available funds (“Dry powder”). At the end of 2019, global buyout funds had a total of $832bn in uninvested committed capital, of which European PE funds account for one quarter. PE firms are now looking to allocate this capital to businesses with a solid plan and robust operations.

Minority equity partners as a solution to COVID-19 liquidity gap

Then adopting a long-term perspective, it is essential for management teams to have enough funding to manage their businesses based on long-term value creation rather than being limited to focus on short-term survival. This applies during the initial shutdown period, but to an even larger extend afterwards when the activity starts to normalize. Opportunities will arise for healthy companies to reshuffle cost structure, launch new product programs, or pursue acquisition opportunities.

As an example, one of Capitalmind Investec’s sell-side processes was last week turned into buy-side engagement, where we will utilize our international presence to support our client in building an even stronger geographically diversified business before going to the market again.

“It is a huge advantage that our client has the financial strength to pursue opportunities right now.”

– Stig Madsen Lachenmeier, Managing Partner at Capitalmind Investec

Private Equity sponsors would be a natural way of securing such flexibility. On the other hand, in the current phase of turmoil valuations will expectedly come down, which makes the timing of inviting a new majority owner into a company challenging. Therefore, financial sponsors who provide equity injection for a minority stake is likely to provide a highly attractive solution, because:

- Valuation is less sensitive since a smaller stake is sold/issued. Additionally, preference share mechanisms can be used to mitigate valuation issues.

- The existing shareholders maintain control of the company while reducing their own risk.

- The minority investor will provide the necessary short-term liquidity to pursue business opportunities arising following the crisis.

There are several Nordic PE funds and family offices doing minority investments in well-driven companies of different sizes (such as IndustriUdvikling (DK), VIA Equity (DK), Kirk Kapital (DK), Priveq (SWE), REITEN & CO (NO), Investment AB Spiltan (SWE), and Formica Capital (SWE)). Larger companies could also attract investments from international minority and special situation PE funds (such as Intermediate Capital Group (UK), H.I.G. CAPITAL (UK), and Mimir Invest (SWE)).

At Capitalmind Investec, we expect these PE investors to constitute an attractive funding solution for many family- and management-owned SMEs in the coming period.