- Home

- News & Insights

- Looking for the ideal buyer for a German middle market business

Looking for the ideal buyer for a German middle market business

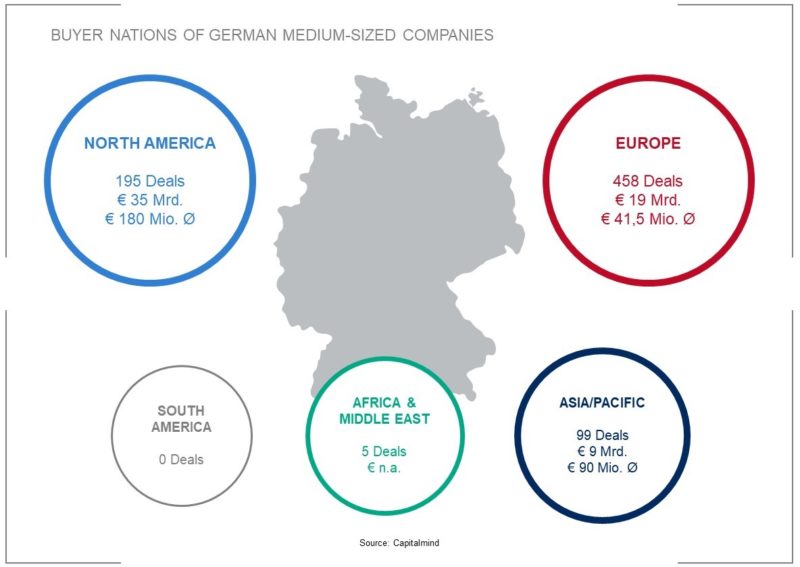

A list of buyers typical for German medium-sized companies comprises of different buyer types and nationalities. This places high demands on marketing strategy, process design and negotiation.

German SMEs are in great demand in the international consolidation of many industries. Every year, more than 1,000 medium-sized companies change hands in Germany for an average of ten times the EBITDA. In this increasingly professional market segment, a large number of potential buyers are now available – especially from abroad. Over 750 German companies were acquired by foreign buyers in 2019. The majority of overseas buyers come from the USA (131) and China (39), but India, Japan and the ASEAN states are also gaining in importance.

In addition, financial investors and family offices are playing an increasingly important role as transaction partners. They accounted for 520 company acquisitions last year. Purely financial motives have become rare. So-called sectoral buy-and-build concepts are often implemented in which local market leaders are bought together, integrated, internationalized and digitalized.

Awakening the interest of financial investors

Participation by financial investors is particularly suitable if the company is not yet ready for a takeover by a listed group, for example, due to its size, lack of focus or “due diligence capability”. These investors pay attractive prices, some of which are significantly higher than those of industrial bidders. In addition, they often offer management and the company an excellent perspective for the further development of the company.

A successful transaction requires good preparation and premarketing to make the target and its equity story known to a few carefully selected investors early on. In this way, the investors gain confidence in the performance and the management and can prepare for the full process later, which positively impacts the outcome for sellers. While it is important to develop a solid common understanding of cooperation, being drawn into bilateral negotiations unprepared and early on should be avoided.

Asian Buyers

Particularly in the industrial sectors for transactions with sales of EUR 50 million or more, Chinese buyers have become indispensable in many processes. Involving them is a challenge and requires tact and sensitivity. The approach should be made in Chinese at the local level of the decision-makers early on before the actual bidding process begins. Visits where seller and buyer get to know each other and where relationships are built up are recommended. The Chinese prefer a long prologue.

It makes sense to concentrate on buyers who can demonstrate proven M&A experience – ideally abroad. As transaction partners, state-owned corporations are complex to deal with.

In the process, the seller should act in a binding, polite but firm manner and with clear and early communicated deadlines. Whoever finds the right investor and has established the right relationship can act very quickly and flexibly and often finds a good partner for the German SME in Chinese buyers.

Large Corporates (listed)

Listed international groups can be a good choice as transaction partners. Due to their public listing, these buyers are generally Anglo-Saxon in character. They appear in large teams managed by an M&A department and act in a rather bureaucratic and schematic manner from a typical “Mittelstand” owners’ perspective. Once approached, corporations expect a streamlined process and should therefore only be approached when the bidding process starts.

Sellers must be confident and well prepared in dealing with this type of buyer, otherwise they will quickly find themselves on the defensive. Large groups are particularly challenging for medium-sized companies, as they themselves are organized more informally. Creative solutions must be found on an ongoing basis in order to be successful.

Professional and individual marketing

Due to the diversity of the buyer universe and the necessary degree of preparation, a preparation process should be started at least one year before the targeted transaction date. It is important that sellers keep the reins and have alternatives.

Processes today require professional and individual marketing. Standard processes regularly fail today. What is needed instead is a suitable marketing strategy and meaningful modular marketing documents that underpin an attractive equity story with well-prepared ad matching financial data. Using this approach the process can be optimally adapted to the individual target groups in terms of time, content and negotiation tactics, and the best results can be achieved.