The Testing, Inspection & Certification (TIC) sector is in robust shape, judging from discussions at Capitalmind Investec’s second annual European TIC Conference (March 2024). Personal experiences shared by the heads of two highly acquisitive TIC businesses offered the audience of 60 industry leaders valuable insights into current Mergers and Aquisitions (M&A) thinking and trends.

The event kicked off with an overview of the state of the M&A market in the TIC sector. Capitalmind Investec has built up many years’ experience providing mid-market TIC companies in the UK, Europe and US with M&A financial advice.

Marleen Vermeer, Partner at Capitalmind Investec, highlighted the growing shift towards a global focus in M&A activity. “Until a few years ago, TIC M&A activity was generally domestically oriented. That is now changing quite rapidly with more cross-border transactions,” she said.

Watch and read the highlights from our European TIC conference

Acquisitions and organic growth

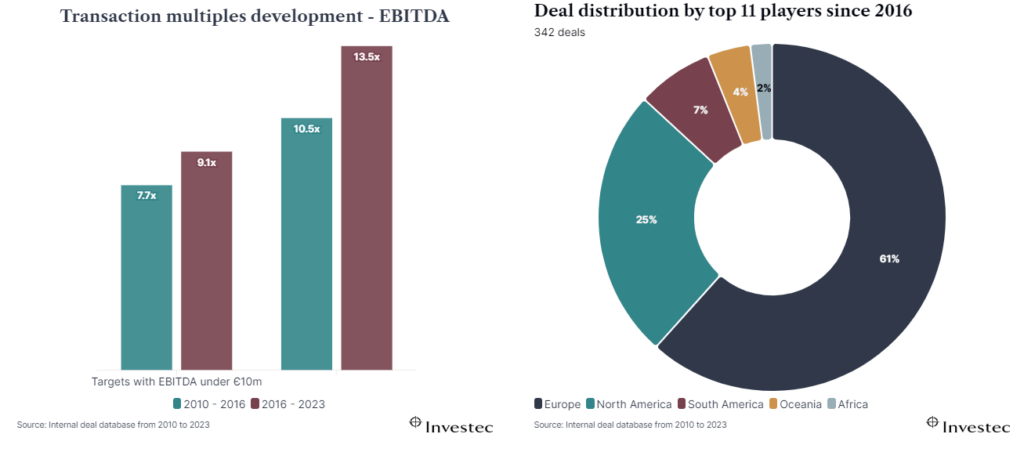

Higher levels of M&A activity than is generally seen in the market are being supported by stable company valuations and high exit EBITDA multiples, as Michel Degryck, Managing Partner at Capitalmind Investec, explained: “We saw a rise in valuations from 2020 to 2022 and they are now more stable. Investors are increasingly paying close attention to organic growth in TIC businesses. Generally speaking, a good valuation multiple requires double-digit organic growth. Companies must also demonstrate that their acquisitions can grow fast to prove they will generate value on top of providing relative multiples.”

Continued consolidation trends, with valuation expansion

In the current economic climate, trade buyers of TIC companies are also keeping a keen eye on pricing power. “The ability to pass through inflation cost by increasing prices is important to potential buyers. Businesses that offer more than just pure TIC services tend to succeed better in passing on higher costs,” Michel noted.

Sustainability, digitalisation and internationalisation

Marleen outlined three important trends in the sector: sustainability, digitalisation and internationalisation. “Investors are looking for sustainability and TIC companies are benefiting from growing societal expectations for a safer, more sustainable world,” she observed. Capitalmind Investec predicts that digitalisation, particularly connected devices and remote services, is changing TIC businesses, said Michel: “TIC companies are looking at how they collect and leverage data, and at using artificial intelligence, to provide their clients with more business value. As a result, TIC companies are moving from ticking boxes to check compliance with regulations to providing risk management solutions and business performance tools.”

Internationalisation was evident in the success stories recounted by France-based Trescal, the global leader in calibration with a busy buy-and-build investment strategy, and Netherlands-based Normec, a rapidly growing TIC company.

Until a few years ago, TIC M&A activity was generally domestically oriented. That is now changing quite rapidly with more cross-border transactions.

Marleen Vermeer, Partner at Capitalmind Investec

Trescal: don’t rush acquisitions

Guillaume Caroit, CEO of Trescal, said around one-quarter of annual turnover growth came from organic growth and the rest through acquisitions. Impressive expansion into 30 countries, with over 5,000 staff and 70,000 global customers is the result of combining caution with ambition.

Guillaume’s advice for an effective M&A strategy is “Don’t bite off more than you can chew. And don’t rush things too much.”

M&A activity helps Trescal to maintain its preferred balance between end-markets as well as diversifying into new geographies. Guillaume said private equity firms were supportive of the strategy. “PE firms like the purity of Trescal as a pure player in calibration which is our core business, plus our ability to attract good managers, especially in new countries.”

Chief among his priorities when integrating businesses is to invest in people. The Trescal Institute supports the retention of skilled technicians and engineers post-acquisition by offering training programmes. “Many of our competitors can’t afford to invest as much as us on people,” said Guillaume. “We train people centrally in Paris and recruit locally around the world.”

Normec: focus on countries and sectors

Joep Bruins, CEO of Normec, set up the company in 2015 and immediately began buying small TIC companies. Normec focuses on only four TIC sectors: food, life safety, sustainability and healthcare. About half of its business comes from acquired companies.

“We have a one-stop delivery model for clients to access all types of labs to meet their needs,” he said. “We also offer label compliance and software development services, so they can receive everything from a single supplier.”

Normec’s organic growth is over 10% and it has made over 60 acquisitions to date. This buy & build strategy has been funded by private equity funds since around 2017.

The company’s geographic spread is currently nine countries. “We try to stay as focused as possible in our core sectors and countries,” said Joep. “Our clients are relatively small and many don’t necessarily need international services. Three-quarters of our revenue comes from small- to medium-sized businesses.”

Once a target is acquired, Normec doesn’t look to relocate or centralise the business. “We keep acquired companies where they are, so we have local labs offering high service levels. It’s fairly easy to integrate them into our wider network. Here, colleagues can learn from each other.”

TIC talking points

To round off the conference, Ed Thomas, Managing Director, UK, at Investec, quizzed Guillaume and Joep, along with Charles Welham, a Partner at asset fund management group Bridgepoint, on how TIC M&A activity is changing.

What are the challenges of internationalisation?

Scaling up activities should be a priority, said Charles: “You shouldn’t look at internationalisation for the sake of it. You need to have in place a team that can scale up in different countries, and this gives you a local presence if things go wrong. It helps to focus on just part of the TIC market, rather than buying everything that’s going.”

Joep emphasised understanding the culture and looking for similarities in acquisition targets. “For me, differences between countries are not as big as differences between individual people. Scaling your business as you acquire is as much a question for your Human Resources as your M&A team.”

Guillaume agreed that a personalised approach is essential. “We do the basics and get a cultural understanding of new countries, like Thailand and China. The calibration sector is so niche that target companies probably know us already, which helps.”

What lessons have you learned?

Having a regionally based group structure is important for Trescal. “Previously everyone reported to me; now we have four regional areas with their own P&L reports and steering committees. It helps us manage local issues more effectively,” said Guillaume.

Maintaining a strong local presence is something Bridgepoint learned the hard way. “Local people often want to speak with local deal originators. We’ve gone wrong on larger deals in new countries by not having done enough commercial due diligence or understanding national regulatory changes,” said Charles.

Organic growth or M&A?

Both Joep and Guillaume highlighted the difficulty of ‘doing it yourself’. Joep said: “Organic growth is very hard. For a start, your labs need to be accredited as well as every test you conduct. That can take one or two years. If you want to grow quickly and scale a business, then M&A is a better way.”

Guillaume agreed: “Creating a ‘green field’ operation takes too long. We have opened a number of our own labs in the last 20 years and ended up shutting most of them down.”

What’s your outlook for TIC M&A?

“Trescal is looking to grow in the Asia-Pacific region and has its eye on China, India and Japan” said Guillaume.

For Joep at Normec, it’s a question of “keeping on doing what we’re doing.”

Bridgepoint expects M&A activity to continue at pace. “There are so many acquisition opportunities in the TIC sector. It’s a true technical sell, which is why we like it so much,” said Charles.

The panel also fielded audience questions on rebranding acquired companies, typical deal execution timeframes, how to support target companies that are not yet investor-ready, and the trend towards consolidation in the TIC market.

Interview

As we enter 2024, the M&A landscape shows signs of recovery, albeit cautiously.

In the episode of the February 20, 2024 of No Ordinary Wednesday, Jeremy Maggs in conversation with Capitalmind Investec experts Jürgen Schwarz, Marleen Vermeer, and Kilian de Gourcuff, Investec’s Head of Cross-Border Finance and International Advisory Charles Barlow, on what key sectors, trends and risks to keep an eye on in 2024.

Click below to listen to the podcast:

Where does opportunity lie for dealmaking in 2024? (investec.com)

Hosted by seasoned broadcaster, Jeremy Maggs, the No Ordinary Wednesday podcast unpacks the latest economic, business and political news in South Africa, with an all-star cast of investment and wealth managers, economists and financial planners from Investec. Listen in every second Wednesday for an in-depth look at what’s moving markets, shaping the economy, and changing the game for your wallet and your business.

Listen to the best of No Ordinary Wednesday: https://www.investec.com/en_za/focus/no-ordinary-wednesday-with-jeremy-maggs.html

Sharp decline in demand on the SSD market in 2023?

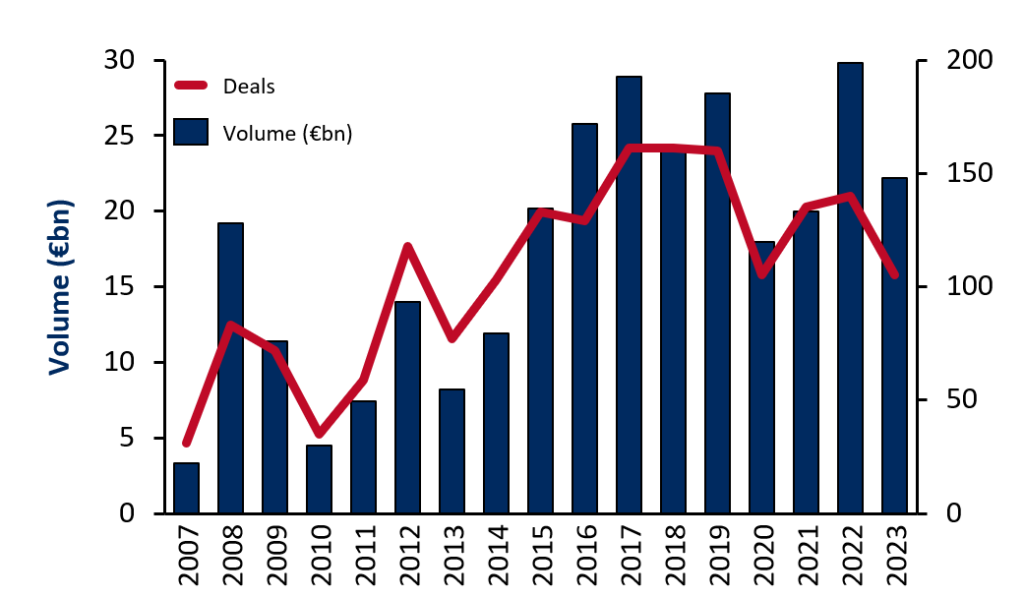

Over the course of 2023, the issue volume decreased by 34%, but still reached a considerable EUR 22.2bn, while the number of transactions fell by 34% to 105. In the record year 2022, the SSD issuance volume had reached an impressive EUR 29.8bn. Interestingly, last year’s total exceeded the average value of the previous ten years by 7%.

View of the SSD market in 2023

In 2023, the market for corporate Promissory note loans (SSD) normalized following the record performance in the previous year, and this trend continued in the fourth quarter. Activity in the SSD market remained robust overall despite a challenging environment in 2023, driven by stable investor demand. Large corporates with external investment grade ratings showed significantly lower participation in the SSD market with 12 transactions compared to the 33 transactions in 2022. From the second quarter of 2023, they tended to increasingly utilize the more competitive bond market, resulting in a lower foreign share compared to the previous year. In addition, fewer debut transactions were recorded in 2023, although some significant transactions by new companies on the SSD market underlined the positive response from investors. At the same time, the market leaves enough room for individualized regulations in the individual companies.

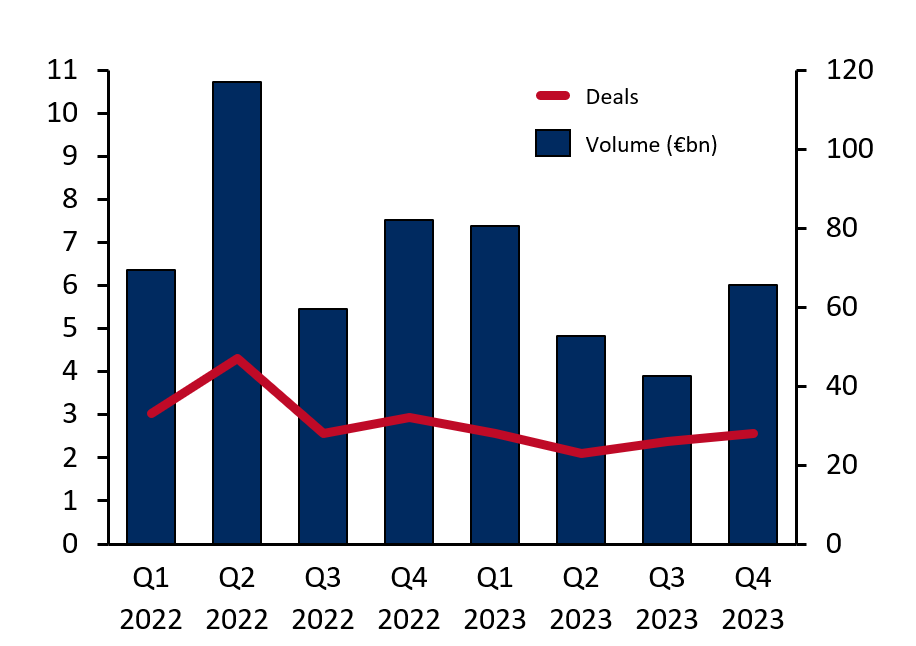

Analysis Q4-Volume

In the fourth quarter of 2023, the SSD market recorded a new volume of around EUR 6 billion, based on valuations. This represents a decline of 25% compared to the record quarter of 2022 with EUR 7.5 billion. At the same time, the number of transactions fell to 28 new SSDs, which also represents a year-on-year decline of 14%.

Compared to the fourth quarters of the past ten years (2013 to 2022), the volume in the final quarter of 2023 was around 16 % below average, both in terms of volume and the number of transactions. Historically, Q2 and Q4 2022 clearly stand out with high volumes.

Click here to download the full report

Financial restructuring for Shareholders & Lenders

Helping clients to navigate uncertainties while putting their businesses back on track

Interview with Jürgen Schwarz, Managing Partner of Capitalmind Investec about Restructuring with the help of a M&A process:

- How did the market change in recent years?

- What is your approach?

- Giving an example

This video answers these questions and give you an idea and overview in a few minutes.

Sale from insolvency

Due to our pan-European presence and track record we are well placed to advise on international and cross-border restructurings.

Our international sector teams implement more than 50 transactions p.a. and in many sectors they know the active buyers, the acquisition criteria, the behaviour of individual decision makers. We also have an up-to-date overview of the market prices paid, which vary considerably over time and depending on the positioning in the sector.

Capitalmind Investec has direct access to numerous international equity and debt capital providers and has carried out numerous restructurings ranging from approximately 10 million Euros to several billion Euros.

Over de deal

Herstructurering en uitbreiding van de oorspronkelijke BEE-transactie en de introductie van een aandelenplan voor werknemers.

Investec Bank heeft Reunert Ltd bijgestaan in de herstructurering en uitbreiding van zijn oorspronkelijke BEE-transactie en de introductie van een aandelenplan voor werknemers. Via deze transactie zal Reunert in aanmerking komende werknemers de kans geven om deel te nemen in de waarde van Reunert, waardoor hun economische belangen beter worden afgestemd op die van andere Reunert-belanghebbenden en het toekomstige succes van Reunert. Het zal ook de empowerment van zwarte vrouwelijke jongeren voortzetten via het Rebatona Educational Trust. Samen zullen de Rebatona Educational Trust en de Employee Share Ownership Trust effectief c.13% van de aandelen van Reunert bezitten.

Over Reunert Ltd

Reunert omvat een gediversifieerde portefeuille van bedrijven in drie hoofdsegmenten: elektrotechniek, informatie- en communicatietechnologie en toegepaste elektronica. Het heeft een portefeuille van bekende en gerespecteerde Zuid-Afrikaanse merken, waaronder CBI-electric, Nashua en Reutech. Reunert zet zich in voor de ondersteuning van Zuid-Afrika’s BEE-initiatieven en heeft in de loop der jaren met succes zwarte mensen geïntroduceerd als aandeelhouders van veel van zijn werkmaatschappijen.

Over de herstructurering van Delticom

Met het merk Reifendirekt is Delticom AG (Duitse Securities Code/WKN 514680, ticker DEX) de leidende Europese online distributeur van banden en complete wielen met c. € 540 miljoen omzet in 2020. Het bedrijf exploiteert c. 350 online winkels en online distributieplatforms in 73 landen, die meer dan 16 miljoen klanten bedienen. Het productportfolio voor particuliere en zakelijke klanten omvat een scala van c. 600 merken en meer dan 40.000 bandenmodellen voor auto’s en motorfietsen.

Capitalmind Investec werd aangesteld als exclusieve adviseur om Delticom AG te assisteren in haar transitieproces en focus op de Europese online business met banden en complete wielen.

Onze rol als M&A adviseur

Capitalmind Investec heeft de Raad van Bestuur van Delticom AG gedurende het hele proces bijgestaan, onder meer met:

- Evaluatie van de verkoop van bedrijfsonderdelen zoals auto-onderdelen;

- Evaluatie van de inkoop van extra eigen en vreemd vermogen;

- Onderzoek van een mogelijke gedeeltelijke of volledige overname van Delticom AG door een investeerder;

- Gerichte internationale aanpak van potentieel geïnteresseerde partijen en afhandeling van het onderhandelingsproces;

- Presentaties van lopende onderhandelingsresultaten aan de financieringsbanken en kredietverzekeraars.

“Jürgen en zijn team hebben ons succesvol afgeronde herstructureringsproces vanaf het begin in augustus 2019 tot medio 2021 begeleid en ons perfect voorbereid op de uitdagingen. Hun diepgaande transactiekennis in de internationale e-commerce- en financieringsomgeving en hun jarenlange ervaring expertise in het kader van herstructureringen hebben aanzienlijk bijgedragen aan ons succes.” Andreas Prüfer, oprichter en directie Delticom AG

Both financial and strategic investors increasingly submit purchase offers directly to company owners. They are often completely unprepared for such an offer. Buyers try to take advantage of this surprise effect.

Both interested parties from the private equity segment and companies themselves are now once again directly approaching company owners or making indicative offers for the purchase of privately owned companies to an extent rarely seen. Due to the ongoing low interest rate policy of central banks, high valuations, attractive growth prospects and high liquidity available for investments, private equity companies are under considerable investment pressure and have therefore significantly increased their direct investment efforts. Similarly, large companies are seeking growth through acquisitions to gain access to technologies and user end markets or to support their record high share prices. Both types of buyers seek to avoid highly competitive and structured transaction processes led by M&A advisors. From the buyer’s point of view, this can optimise the transaction duration and the purchase price – to the detriment of the seller.

Optimise sale price

Recently, we were approached by a business owner who had received an unsolicited offer to buy his company from a larger industrial partner. This original offer was around EUR 28 million. The entrepreneur sought advice because he was unable to assess the offer due to the lack of an accurate idea of the value of his company. At the same time, no preparations had been made for a possible sales process. Although there was a certain curiosity about a sale in terms of long-term succession planning, the topic of a company sale was not (yet) on the agenda due to positive business prospects.

The company had a current EBITDA of around EUR 4 million, attractive margins, a good reputation, and long-standing relationships with an international customer base. As with many SMEs, there was a noticeable concentration on certain customer sectors in this case.

We were able to argue and convince the entrepreneur that a higher sales price usually could be achieved through a thorough preparation of information and documents as well as a competitive sales process. Special attention was paid to the formulation of an attractive “equity story”, which was derived from the positioning of the company, its unique selling propositions, and its growth potential. Equally important was a review and preparation of the financial history as well as the short- and medium-term corporate planning, ideally consisting of an integrated P&L, balance sheet and cash flow planning.

After preparing the sales documents, a multi-stage sales process was initiated and structured in which both potential strategic buyers and selected financial investors such as private equity companies and family offices were approached. Relevant company information was first made available to interested parties by means of a teaser and investment memorandum and, in a later step, via an electronic data room. The confidentiality and sensitivity of certain information was always taken into account through the gradual disclosure, which was adapted to the stage of the process or negotiations.

The company was ultimately sold to the original bidder for more than EUR 36 million. This represents a significant improvement over the initial bid – without any material change in the operational or financial situation.

Don’t get rattled

Buyers try to take advantage of the element of surprise by proactively making offers. Such offers are often not only below the achievable market price, but they address companies and owners unprepared. A professionally structured divestment process can increase the probability of success of a transaction and optimise the transaction terms, including the final purchase price, in favor of the seller.

Don’t reveal too much too soon

Sometimes, as advisors, we are only brought into a sales process when talks with the prospective buyer are already underway or – regrettably – deadlocked. By this time, a lot of information has often already been given to the prospective buyer, which tends to weaken the seller’s position. In such a situation, it is important to regain control of the transaction process. By preparing well for the due diligence and by including possible other interested parties in the divestment process, the seller’s negotiating position can be improved. The further process may or may not include the original bidder.

By proceeding in this way, business owners can be sure that they can optimise the valuation as well as better control the contractual arrangements of the final buyer. With a view to a careful preparation and structured implementation of a sale, it is in this respect helpful to involve or cooperate with specialised advisors as early as possible.

Cooperation with “business confidants”

We have been “in the market” since 1999, during which time Capitalmind Investec has built trusting relationships with numerous financial institutions, tax advisors, auditors, and other business confidants. We understand and respect the history of relationships, therefore clear agreements and responsibilities are important to us. As an advisor specialised in corporate transactions and financing, we rely on close cooperation with these players as well, in order to bring together expertise and drive for the benefit of the client.

Over de verkoop van Klinikum Peine gGmbH

Na economisch moeilijke jaren voor ziekenhuizen in Duitsland is de Stiftung Allgemeines Krankenhaus Celle in financiële moeilijkheden geraakt. Om deze reden moest een mogelijke verkoop van Klinikum Peine worden overwogen. In de loop van het proces verslechterde de economische situatie van Klinikum Peine gGmbH verder, waardoor een faillissement volgde. Uit dit faillissement is het ziekenhuis op 1 oktober 2020 in gemeentelijke handen overgegaan. Het district Peine nam een belang van 70% in de onderneming en de stad Peine een belang van 30%.

Klinikum Peine is een ziekenhuis dat basis- en standaardzorg in Nedersaksen biedt met een groot regionaal bereik. Het is het enige ziekenhuis in de stad Peine. Het ziekenhuis biedt medische basiszorg op het gebied van algemene chirurgie, vaatchirurgie, ongevallenchirurgie, geriatrie en interne geneeskunde. Met iets minder dan 300 bedden en 14.000 patiënten per jaar is het een van de middelgrote ziekenhuizen in Duitsland.

Met in totaal 615 bedden is het Allgemeine Krankenhaus Celle, een stichting naar burgerlijk recht, een van de grootste ziekenhuizen voor acute zorg in Nedersaksen. In totaal 26 ziekenhuisafdelingen, waaronder 3 intensive care-afdelingen, bieden jaarlijks aan ongeveer 30.000 patiënten intramurale zorg. Met ongeveer 1.900 werknemers, waaronder 230 artsen en 750 verpleegkundigen, is de stichting een van de grootste werkgevers in de regio.

Onze rol als M&A adviseur bij de verkoop van

Klinikum Peine gGmbH

Advies gedurende het verkoopproces aan het management van Klinikum Peine gGmbH

- Voorbereiding van de transactie en alle marketing documenten (teaser, informatie memorandum)

- Benadering van potentiele kopers

- Analyse van indicatieve biedingen

- Voorbereiding en coördinatie van due dilligence proces inclusief dataroom en Q&A

Onze rol bij de overname door BOSA Group

Capitalmind Investec identificeerde Schweizer Group Suzhou als doelwit voor BOSA en startte overnamebesprekingen met de curator. Als buy-side adviseur van BOSA hebben wij geadviseerd in alle stappen van het structureren, onderhandelen en uitvoeren van de transactie.

Over de overname van Schweizer Group Suzhou

Als toonaangevende leverancier van staal en aluminium elementen aan de automobielindustrie, was BOSA op zoek naar diversificatie in de aluminium spuitgietsector. Capitalmind Investec heeft naast Schweizer Group Suzhou verschillende alternatieven onderzocht.

BOSA Group LLC, met het hoofdkantoor in Pejing, China, heeft 100% van de aandelen van Schweizer Group Diecasting Co Ltd., Suzhou, China, overgenomen van Schweizer Group International GmbH, Duitsland. De aankoopprijs wordt niet bekendgemaakt.

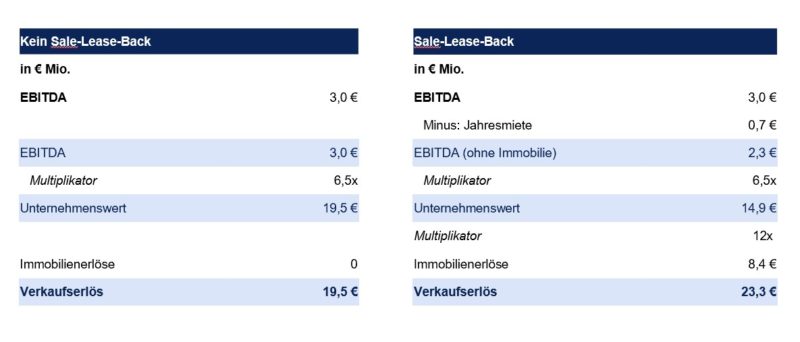

Case Study Sale and Leaseback of Corporate Real Estate Purchase Price 20% +

Frequently, medium-sized companies fail to realize the value of the real estate in the context of a total sale and forego significant economic benefits. As the example “No sale-leaseback-back” below clearly shows, the EBITDA multiple applied by the buyer does not value the company’s real estate at its market value.

Also, a company with business premises is often less attractive for the buyer. In contrast to medium-sized companies, international listed companies and those in private equity ownership try to avoid tying up capital in real estate to a large extent.

Offer becomes more attractive through lower capital commitment and flexibility

Owners can therefore make their offer more attractive to a broader group of buyers by selling the property in the run-up to a transaction or parallel to it, for example to investors and/or real estate financiers specializing in corporate real estate.

High economic advantages reward the additional effort

In this example, we were able to achieve approximately 4 million (20%) higher revenues for one customer. Although the transaction was somewhat more complicated, the economic benefit shows that the effort was justified and that it was worthwhile.

Also, a financing alternative

In the case of refinancing, restructuring and growth and acquisition financing, the sale and lease back of real estate must be examined for its advantages. Please read our article “Sale & Lease Back as a financing alternative”.

What to do when earnings fall, liquidity becomes scarce and existing investors say no?

In crises such as COVID-19, the first priority is to ensure the company’s liquidity by taking advantage of all aid programmes and by securing promotional and guarantee loans. However, falling earnings and cash flows and weak liquidity also require rapid operational and financial restructuring to make the company weatherproof in the long term.

While the basis of a restructuring is of course always a solid operational restructuring concept, the existing capital structure must be adapted to future cash flows with the same high priority. Refinancing/rescheduling of debt and the sale of non-strategic or non-operational assets are often essential elements in this process.

Dissolve blockade with a clear concept for restructuring

Although a good operational concept often exists, unfortunately many companies slide into insolvency despite good approaches because they cannot (or not fast enough) explain to stakeholders what the concept means for them financially and what their specific benefit will be after its implementation.

In more complex cases, a financial restructuring concept depicting the cash flows and values throughout the restructuring phase and thereafter across the various financing instruments and capital providers is required. The concept clarifies to all stakeholders the consequences of the restructuring for their own values and the associated opportunities and risks. A consensus can only be reached if this is done professionally, i.e. if each stakeholder knows his options and perspectives.

The capital structure must be adapted as best as possible to the new cash flow patterns in the crisis. In this way, insolvency can be avoided, values preserved, and the success of the company secured.

Capitalmind Investec case study Wohnbau Mainz

Clear restructuring concept, debt payback via sale of non-core assets and subsidiaries, refinancing via syndicated loan

Due to inefficient operating structures, excursions into risky project development and a barely manageable complexity of bilateral loan agreements and special purpose companies, the residential real estate company of the City of Mainz was plunged into an earnings and liquidity crisis with dimensions threatening its existence. We were given the mandate to develop and implement a concept for the financial restructuring of their approximately € 1bn million balance sheet.

Standstill agreement and restructuring agreement negotiated

Following our appointment, we worked with the CRO and the operational restructuring advisors to develop a viable restructuring concept for the shareholders’ meeting and the creditors’ committee, within a few weeks. The concept detailed and clarified the rating and valuation consequences of all structural and operational measures as well as the sale of assets proposed by us for the individual stakeholders.

On this basis, we were first able to conclude a standstill agreement with the lenders and then based on an IBR (IDW S6 expert opinion) we were able to negotiate a restructuring agreement with all parties.

Conversion and refinancing in syndicated loan for Wohnbau

The agreed sales and cost-cutting measures were implemented, thereby improving the debt capacity and debt service capacity of Wohnbau Mainz.

The company was split up into a stable residential construction company with an investment grade rating and a rather risky project development company. Non-strategic property portfolios were sold. The proceeds were used to reduce debt and to renegotiate over 80 bilateral and cross collateralized loans that were ultimately bundled into a syndicated loan.

Solidly positioned after successful financial restructuring

Today Wohnbau Mainz is once again a solidly positioned company with a stable and sustainable financing structure. The value of the company has been maintained for the shareholders and creditors. An insolvency and thus a massive destruction of value was avoided.

Capitalmind Investec has successfully accompanied more than 60 financial restructurings over the last decade

Capitalmind Investec, has been assisting its clients in such complex refinancing and restructuring transactions for over 15 years. We know the objectives of all stakeholders well, having successfully solved cases for companies and their shareholders as well as for banks and other creditors. In over 90% of cases, on whichever side, we have been able to reach a consensus between these groups on the necessary restructuring measures.

Core competences, company valuation, rating, financial modeling, capital raising and Selling companies

Our core competencies include financial modelling, rating analysis and company valuation as well as the preparation of internal committee documents for banks/creditor pools and shareholder/supervisory bodies. We develop a conclusive debt and equity story for existing creditors and new debt and equity investors.

We subsequently implement the measures, negotiate restructuring agreements and raise capital. We support you in the sale of subsidiaries and non-strategic business units through restructurings which are advised in close cooperation between our global sector teams and our capital advisory groups.

Minority investments on the rise in the short-run as private companies seek funding to overcome the COVID-19 crisis

The COVID-19 liquidity gap

The financial impact of the sudden COVID-19 pandemic is already severe in many businesses facing extremely low or no activity at all. Naturally, this will quickly lead to a liquidity shortage. As the full economic impact of the current global COVID-19 outbreak remains unpredictable, governments place their trust in aggressive fiscal and monetary policies as well as flexibility from the established banking system.

However, in many cases this is likely to prove insufficient:

- Businesses are already facing short-term liquidity issues, and the length of the crisis remains highly uncertain. Financial planning is close to impossible.

- Government support packages help in the very short-term, but only partly.

- The banking system is rigid and scared of the last financial crises. They will be reluctant towards more exposure, also due to rapidly increasing debt-to-EBITDA levels as a result of lower business activity.

- Even if the strategy will help companies survive, in many cases the businesses will still be forced to cut back investments for several years to recover and regain the same financial strength.

Therefore, many business owners need to search for more flexible solutions to maintain their position on the market towards suppliers, customers, employees, etc.

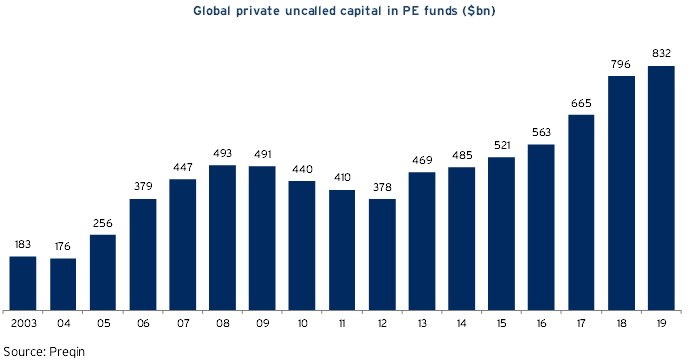

Private Equity funds are piling up cash

Private Equity firms provide flexible funding solutions and have all-time high levels of available funds (“Dry powder”). At the end of 2019, global buyout funds had a total of $832bn in uninvested committed capital, of which European PE funds account for one quarter. PE firms are now looking to allocate this capital to businesses with a solid plan and robust operations.

Minority equity partners as a solution to COVID-19 liquidity gap

Then adopting a long-term perspective, it is essential for management teams to have enough funding to manage their businesses based on long-term value creation rather than being limited to focus on short-term survival. This applies during the initial shutdown period, but to an even larger extend afterwards when the activity starts to normalize. Opportunities will arise for healthy companies to reshuffle cost structure, launch new product programs, or pursue acquisition opportunities.

As an example, one of Capitalmind Investec’s sell-side processes was last week turned into buy-side engagement, where we will utilize our international presence to support our client in building an even stronger geographically diversified business before going to the market again.

“It is a huge advantage that our client has the financial strength to pursue opportunities right now.”

– Stig Madsen Lachenmeier, Managing Partner at Capitalmind Investec

Private Equity sponsors would be a natural way of securing such flexibility. On the other hand, in the current phase of turmoil valuations will expectedly come down, which makes the timing of inviting a new majority owner into a company challenging. Therefore, financial sponsors who provide equity injection for a minority stake is likely to provide a highly attractive solution, because:

- Valuation is less sensitive since a smaller stake is sold/issued. Additionally, preference share mechanisms can be used to mitigate valuation issues.

- The existing shareholders maintain control of the company while reducing their own risk.

- The minority investor will provide the necessary short-term liquidity to pursue business opportunities arising following the crisis.

There are several Nordic PE funds and family offices doing minority investments in well-driven companies of different sizes (such as IndustriUdvikling (DK), VIA Equity (DK), Kirk Kapital (DK), Priveq (SWE), REITEN & CO (NO), Investment AB Spiltan (SWE), and Formica Capital (SWE)). Larger companies could also attract investments from international minority and special situation PE funds (such as Intermediate Capital Group (UK), H.I.G. CAPITAL (UK), and Mimir Invest (SWE)).

At Capitalmind Investec, we expect these PE investors to constitute an attractive funding solution for many family- and management-owned SMEs in the coming period.

Private companies prepared to use modern financing instruments to benefit from opportunities in economic downturn

Companies should proactively reconsider their financing strategies. There is a risk that in the aftermath of the economic downturn, bank loans will become considerably more expensive or will not be renewed particularly for borderline and non-investment-grade borrowers.

Many traditionally financed medium – sized companies not willing to embrace change will be under pressure. They have received unprecedented amounts of bank loans, a considerable proportion which were granted in the form of short-term, supposedly cheap bank loans. Short term bank debt will now put a strain on both profitability and cash flow and expose many to risk due to the short-term nature of the financing commitments.

Proactive private companies across all sectors can shift and consider the liquid “private debt market” to secure longer-term financing solutions with bullet maturities or a low repayment rate. Additionally, raising subordinated capital, preferred capital, preferred equity or mezzanine capital up to minority shareholdings, entrepreneurs can increase their flexibility in different business situations. They will achieve financing security and the flexibility to take advantage of attractive investment and acquisition opportunities.

Please feel free to talk to us, we are constantly in touch with approx. 200 debt and mezzanine capital providers, many of which are currently open for business and remain providing financing to medium – sized companies.

Ervin Schellenberg of Capitalmind Investec explains in an interview why companies should look for alternative financing instruments.

To read the full interview (in German) click here

Onze rol als M&A adviseur bij de financiering van een toonaangevend verhuurbedrijf

Capitalmind Investec heeft uitsluitend de aandeelhouders geadviseerd over de kapitaalstructuur van de onderneming. Daarnaast ondersteunden we de aandeelhouders bij de uitvoering en projectcoördinatie gedurende het hele proces. Ten slotte, projectbeheerde contractonderhandelingen en -afsluiting.

Wat we voor de Management Buy Out van van Laack hebben gedaan

Capitalmind Investec heeft het management en de aandeelhouders van van Laack’s geadviseerd bij de Management Buy Out. Hiervoor hebben we diverse (internationale) partijen en een aantal geselecteerde partners benaderd. Daarnaast hebben we advies gegeven over het opzetten van een nieuwe kapitaalsstructuur dat past bij het groeiplan van de onderneming.

Over de MBO van van Laack

Van Laack is een leidende, internationale, Duitse premium overhemdenfabrikant met meer dan 135 jaar geschiedenis. De uitmuntende kwaliteit van de overhemden van van Laack heeft geleid tot een sterke marktpositie in het betaalbare/premium segment. Het bedrijf heeft een geïntegreerde opzet met twee state-of-the-art bedrijven, die als als fundament van het bedrijf fungeren. De producten worden wereldwijd verkocht via eigen winkels in belangrijke steden en winkelcentra, een online winkel en via geselecteerde groothandelaren.

Deze transactie is een belangrijke stap voor de verdere ontwikkeling van het bedrijf.

Wat we gedaan hebben voor Pieroth Wein AG

Capitalmind Investec trad op als exclusief financieel adviseur van Pieroth Wein AG bij de verkoop van Pieroth Retail GmbH. We hebben de verkoper en het management gedurende het hele proces ondersteund, inclusief de identificatie en aanpak van internationale kopers met een sterke focus op strategische kopers, de voorbereiding van alle documenten, ondersteuning van het due diligence-proces en beheer van de dataroom, hulp bij het onderhandelen over de deal en de uitvoering van de transactie.

Over de verkoop van Pieroth Retail aan Schloss Wachenheim

Pieroth Retail GmbH (PRE) is een van de toonaangevende meerkanaals wijnhandelsketens van Duitsland met een bekroonde online winkel (www.vino24.de) en 18 winkels in het hele land, met een assortiment van enkele honderden wijnen, delicatessen en wijnaccessoires. De transactie is een belangrijke mijlpaal voor zowel Pieroth Wein AG als Schloss Wachenheim AG. Deze strategische transactie zal Pieroth Wein AG ondersteunen bij zijn inspanningen om zich verder te concentreren op zijn kernactiviteiten en is tegelijkertijd een ideale aanvulling op de retailonderneming Rindchen’s Weinkontor (www.rindchen.de) van Schloss Wachenheim AG. Met de overname zal Schloss Wachenheim AG zijn retailcapaciteit verdubbelen en wordt het de tweede grootste speler op de Duitse wijndetailhandel.

Pieroth Wein AG is een toonaangevende verkoper van exclusieve wijnen, mousserende wijnen en champagnes, sterke dranken van hoge kwaliteit en vruchtensappen die zijn producten aanbieden in Duitsland, Japan, Groot-Brittannië, Frankrijk, Zwitserland en andere landen. Opgericht in 1675 had het bedrijf in 2018 circa 2.400 werknemers en genereerde verkopen van €230 miljoen.

Schloss Wachenheim AG is een van Europa’s toonaangevende fabrikanten en distributeurs van mousserende wijn van hoge kwaliteit en semi-mousserende wijn. Een van de meest bekende merken zijn Faber in Duitsland, Charles Volner en Muscador in Frankrijk, LIGHT live en Robby Bubble in Duitsland, Cin & Cin, Fresco en Cydr Lubelski in Polen, evenals Zarea en Milcov in Roemenië. In 2018 genereerde Schloss Wachenheim AG een omzet van circa €325 miljoen.

Onze rol als M&A adviseur

Capitalmind Investec heeft een onderzoek gedaan naar strategische opties, waaronder een gerichte internationale aanpak met de focus op strategische investeerders, ter ondersteuning van de schuldeisers’ vertrouwenspersoon Dr. Holger Leichtlee van Schultze & Braun, algemeen vertegenwoordiger Martin Mucha van GRUB BRUGGER en de eigenaar & CEO Albrecht Maier, in de context van AWG’s insolventie in zelfbestuur (“Schutzschirmverfahren”). Binnen een paar weken gaf Capitalmind Investec gedetailleerde feedback van de beslissingsmakers van relevante koper aan de stakeholders van AWG. Vanwege de internationale afzetmarkt en diepgaande ervaring in moeilijke situaties, Capitalmind Investec verzekerde een snelle levering van gekwalificeerde aanbiedingen aan de commissie van de schuldeisers als een basis voor het besluitvormingsproces.

Over het Strategisch review voor AWG

AWG Allgemeine Warenvertriebs-GmbH, opgericht in 1969 in Köning in de buurt van Stuttgart, is een van de belangrijkste spelers in de Duitse kleding retail industrie en biedt een brede selectie van eigen merken en merken van derden voor heren, dames en kinderen. AWG heeft meer dan 2,000 mensen in dienst en realiseert een omzet van meer dan € 250 miljoen.

Selling non-core businesses – How to optimize value creation?

Key takeaways from our report:

- Create value

Research shows that businesses that engage in regular divestitures create significant shareholder value down the road. Actively pruning the business portfolio reduces complexity, sharpens the operational focus and generates cash for the next phase of growth. Also note that a pure play is easier for investors to understand. - Transformation

Most businesses are set up to buy assets, not sell them, which means decisions to sell are often made at the wrong time or in the wrong manner. The key is to avoid ad-hoc or reactive decisions, and to carefully manage and prepare the planned divestiture so that it supports the company’s core strategy. Don’t let emotions get in the way. View divesting as a strategic tool. - Plan & prepare

We are seeing higher valuation multiples and faster closings for assets that have been properly prepared – ie. made attractive to potential acquirers. This means setting up a control centre so the process is run professionally and systematically. Communicate clearly, promptly, and frequently: inform shareholders and employees about the divestiture early on, and keep them informed as it progresses. - Target the right buyers

Identifying buyers usually means hiring the right advisors with exposure to the best-owner universe – serious, credible and with genuine sector expertise. Tell a clear and compelling business story. Explain the growth opportunity, the assets’ capabilities, and tailor the potential synergies for investors. - Sell at the right time

Work out what drives the industry cycle, and time the divestiture to optimize the valuation. For companies, now is an ideal time to consider a sale because valuation multiples are at historically high levels in the mid-market and buyers are acquisitive and sitting on large war chests of cash. Also, the decision to divest needs to be proactive rather than reactive. Executives often hesitate to sell assets, which is leaving a lot of value on the table.