- Home

- News & Insights

- Vision Tech: Markets, Valuations & Automation Integration

Vision Tech: Markets, Valuations & Automation Integration

Chip shortage slows down the industry, high level of order income leads to promising outlook for 2022.

According to industry association VDMA the European machine vision industry showed relative strength in 2020 compared to other areas of the machine building industry. In the coming years growth prospects keep looking good, as the trend towards „seeing machines“ has been unbroken for years.

In addition to industrial applications, in which machine vision has become a key component in the global automation race, non-industrial fields of applications such as medtech, security, agriculture, traffic or retail already represent one third of the market. Embedded vision in combination with deep learning will set new growth impulses.

Discussions during the recent industry trade fair VISION show that the vision industry is not exempt from the current chip shortage and bottlenecks in supply chains, which lead to a delay in the delivery of products currently. However, despite multi-layered material shortages across industries, the demand for image processing is not affected, which is why order books are strong and VDMA sticks to its forecast of 7% turnover growth for the European machine vision industry both in 2021 and in 2022.

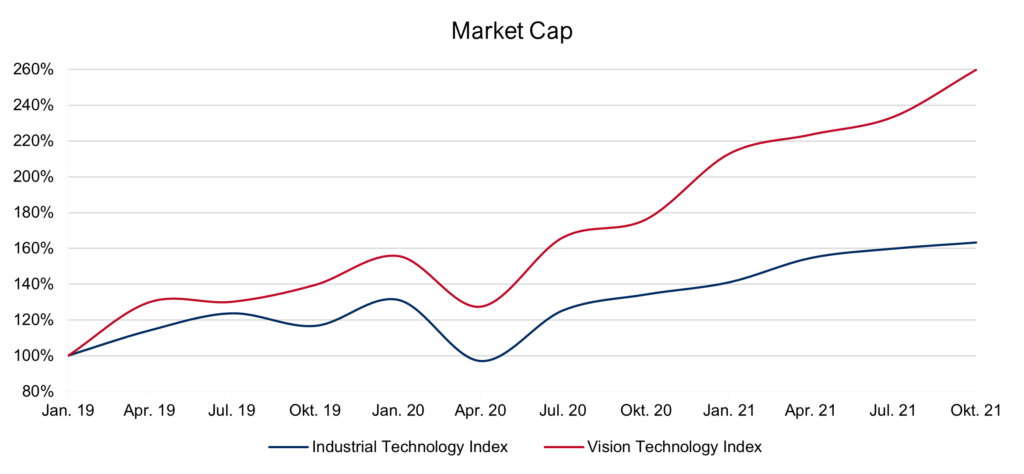

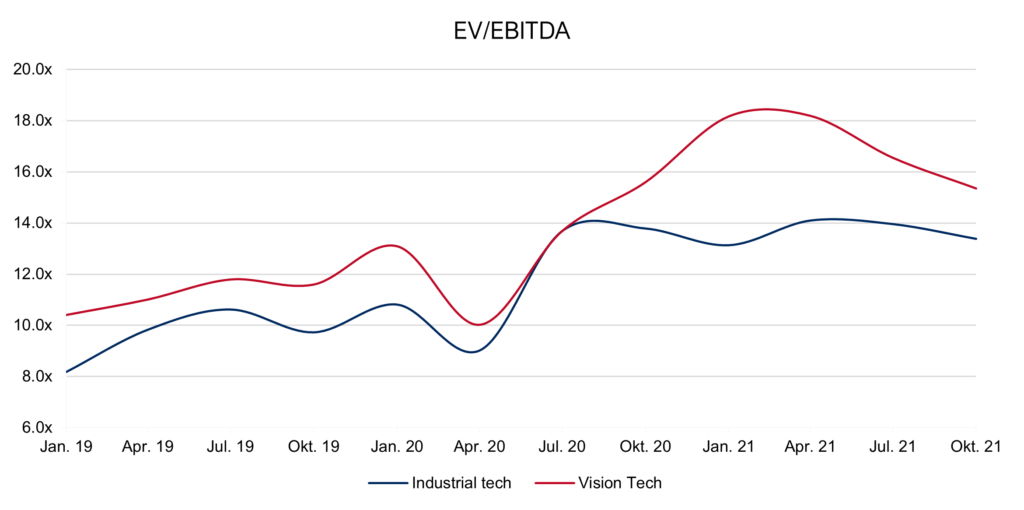

Let’s take a look at how valuations of public vision tech companies have developed, compared to Capitalmind Investec’s Industrial Technology Index, which we update and comment regularly on our websites.

Valuation update

More than 1.5 years after the outbreak of the Corona pandemic, the Industrial Technology Index is persistently at a high level after stabilizing. The total (equity) value of the companies included in the index is around 80 percent above the pre-Covid level. Since the Covid dip, absolute earnings (EBITDA) have risen by 30%(!), while average net debt has fallen by 20%. As a result, relative valuations (EV/EBITDA) decreased to 13.5x (15.2x previous year).

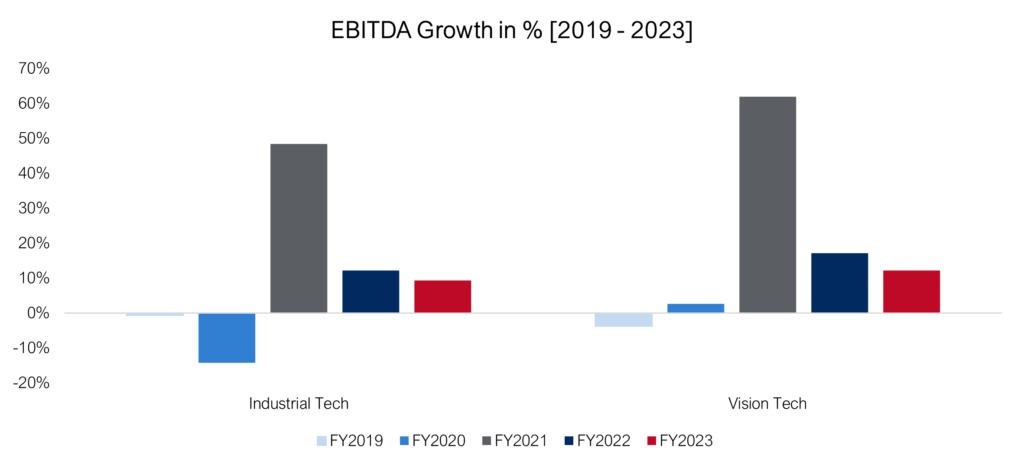

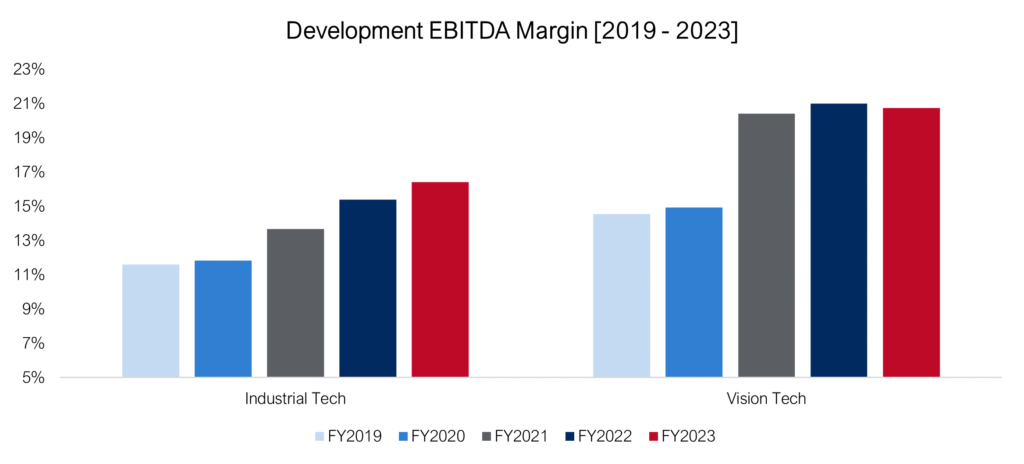

Vision tech companies even show a stronger performance compared to the rest of the Industrial Tech index (e.g., controls, integrated providers, engineering, machinery) both pre and post Covid.

Going a bit more into the details of earnings quality, the vision tech subsector shows higher levels both in growth and in margin historically and in the forecast outlook.

Vision Technology in Industrial Automation

Integration of all systems in the „smart factory“ plays an ever-growing role. The industrial internet of things is supplemented by additional aspects such as digital models of reality (digital twins) and the collection and use of large amounts of data (big data analysis).

Vision systems are already a central component of the modern factory. As a rule, sensors are used to collect data, and image processing systems and cameras play a major role as their core components. However, in order to make this data usable it needs to be processed in such a way that different systems can access it, processes can be triggered, and further decisions can be made.

In the ongoing development of factory automation from the classic level structure (field level, control level, process management level, enterprise level) to a fully interoperable, centrally controlled network, standards and the „common language“ of components therefore play a decisive role. OPC Unified Architecture (OPC UA) is such a standard for data exchange in industrial communication. It can be used from the lowest field level (sensors, actuators) to the information levels (SCADA, ERP) and into the cloud, thus enabling not only horizontal networking within a level, but also vertical networking within the entire factory.

In order to be able to successfully implement the described networking across the different levels, real-time capability is of elementary importance. The reduction of latency times is made possible by edge computing, which enable data analytics to be moved to where the data is collected and 5G technology speeding up data transmission. With industrial AI and machine learning algorithms, another big step towards even more efficient production, new business models and applications is coming into focus. OPC UA joins here providing a uniform communication protocol.

Innovation, the combination of hardware and – ideally cross-system – software competence and system openness thus continue to be the basis for a sustainably successful positioning on the market for the computer vision players.

The Capitalmind Investec Industrial Technology Index tracks daily developments in sectors such as Control Tech, Industrial Software, Integrated Providers, Engineering, Machinery, Vision Tech & Robots/Motions.

The index includes valuations, growth projections, profitability margins and other metrics: https://capitalmind.com/industrial-tech-bewertungentwicklung-2019-2023/

You can find more information on our website at https://capitalmind.com/industrials/

Capitalmind Investec has got a senior sector team in Industrial Technology and we are experienced experts in selling, buying and financing businesses.

If you have questions and would like to know more about valuations, buyer activity and current opportunities in the market – please contact arne.laarveld@capitalmind.com