- Home

- News & Insights

- The world likes organic

The world likes organic

- The global consumer organic packaged food & beverage market is worth around €38.4 billion, and continues to grow strongly across the globe, at a CAGR2017-2021 of 15%.*

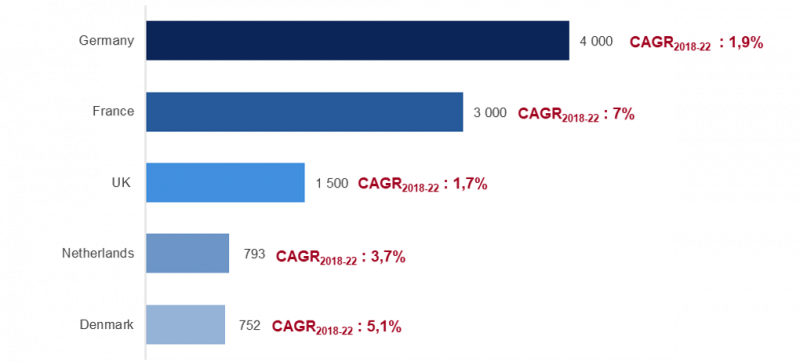

- Here in Western Europe growth varies widely: France is the 3rd largest market in the world and forecast to grow at a much faster rate than the European average, at a CAGR2018-2022 of 7%.*

- We are seeing the entire value chain (farmers, industrial producers, processors and retailers) reposition for future growth. We are also seeing more opportunities for M&A – to tap growth and consolidate this fragmented market.

ORGANIC PACKAGED FOOD & BEVERAGES (MARKET WORTH in €m)

Source: https://globalorganictrade.com/country/france

GROWTH DRIVERS

- Rising lifestyle diseases such as diabetes and obesity are making people more health conscious.

- Millennials are generally more health conscious, and driving sales growth as they mature and earn higher incomes.

- Social media continues to raise awareness; and the rise of ‘influencers’, whose preferences also tend to be organic.

- Upstream innovations are improving efficiencies and production rates – eg. automation (robots) are supporting farmers without the need for chemicals.

- Rising disposable incomes in mature and emerging markets.

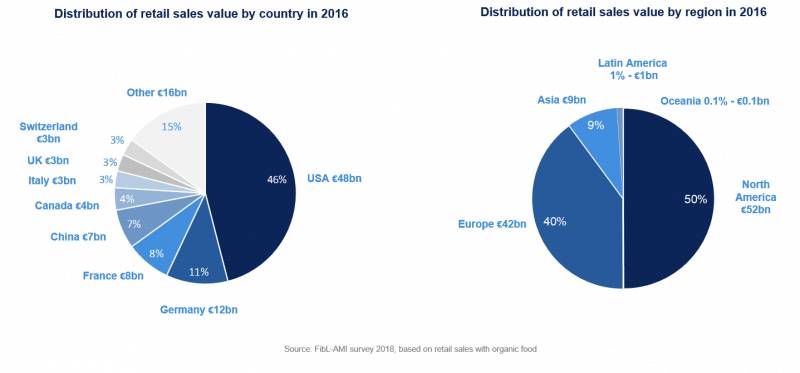

DISTRIBUTION OF ORGANIC RETAIL SALES BY GEOGRAPHY

Worldwide net sales of all organic food amounts to c. $110 billion. (Note: this includes the entire organic food market including raw fruit & veg, etc.)

FRENCH MARKET

*France is the EU’s largest agricultural producing country, while its organic food & beverage market is already the third largest in the world, worth c. US$3.1bn in 2017.

*The organic farming market grew by a massive 17% in 2017, reaching €8.3bn, according to the French Agency for the Development and Promotion of Organic Agriculture. At the end of 2017, there were a total of 36,691 organic farmers in France, up 14.7% on the previous year, representing 8.3% of all French farms and 6.6% of total cultivated areas. In 10 years, areas producing organic has more than tripled, from 517,000 hectares to 1.78 million hectares.

*And yet, in 2017, domestic production couldn’t keep up: organic food imports grew in 2016 and 2017 for the first time since 2009, accounting for almost one-third of the organic food consumed in France, according to a Coface study.

*The major supermarket chains are rapidly expanding their organic offerings: Lidl recently introduced a line of 40 organic products; and Carrefour is now opening dedicated organic outlets in cities outside Paris, where it already has 10; and speeding up its creation of a range of everyday “French organic” products sold under its Carrefour Bio brand. Carrefour France generated revenues of €1.2 billion from sales of organic products in 2017 (compared with total revenues of €35 billion). The aim is to increase this figure two-fold between now and 2022, with the emphasis on increasing sales of organic products made in France.

*Sustainable farming is taken extremely seriously in France. For example, the country has forbidden the growth of GMO foods since 2008; and recently took a radical step towards protecting its dwindling bee population by becoming the first country in Europe to ban all five pesticides researchers believe are killing off the insects – the EU only voted to outlaw the use of three of them in crop fields. France also has many historic quality labels, such as Label Rouge, which ensures that animals are raised according to strict dietary and humane standards including access to the outdoors. Label Rouge beef is grass-fed, and Label Rouge veal and lamb are allowed to consume milk for a longer period of time before being weaned. This label also forbids the use of antibiotics and growth hormones, and medical treatments of animals bearing the label are kept to a strict minimum.

A FRAGMENTED MARKET RIPE FOR DEALMAKING

In France, the competitive landscape is widely fragmented and also highly competitive, led by a small number of large Food & Agro groups, and increasingly private equity funds. These larger players are interested in making acquisitions that consolidate the market and provide growth opportunities to ‘buy & build’ innovative organic concepts.

We have seen some interesting deals emerge in the French organic retail market over the past 12 months.

![]() April 2019: PAI Partners and investor Charles Jobson agree to acquire 100% of Koninklijke Wessanen (2018 rev: €628m) – the Dutch leader in healthy, organic and sustainable products. The investors will support management’s existing strategy, including upgrading operations to improve efficiencies across the entire value chain of the business, and adding scale in core categories and markets through acquisitions. “Our vision is to build a European leader in organic and sustainable food,” explains Christophe Barnouin, CEO of Wessanen. “We want to remain at the forefront of making food healthier and more sustainable for the benefit of both consumers and the planet. It is all the more critical in an era where organic, sustainable and healthy themes have grown increasingly popular, which in turn has resulted in a more competitive environment.”

April 2019: PAI Partners and investor Charles Jobson agree to acquire 100% of Koninklijke Wessanen (2018 rev: €628m) – the Dutch leader in healthy, organic and sustainable products. The investors will support management’s existing strategy, including upgrading operations to improve efficiencies across the entire value chain of the business, and adding scale in core categories and markets through acquisitions. “Our vision is to build a European leader in organic and sustainable food,” explains Christophe Barnouin, CEO of Wessanen. “We want to remain at the forefront of making food healthier and more sustainable for the benefit of both consumers and the planet. It is all the more critical in an era where organic, sustainable and healthy themes have grown increasingly popular, which in turn has resulted in a more competitive environment.”

December 2018: The Japanese food distribution giant Aeon takes a 20% stake in the French bio store chain Bio c’Bon (2018 rev: €150m), which is owned by the French private equity house Marne & Finance. The chain currently operates 154 outlets, of which 64 are in the Paris region and 33 are abroad. Together the owners plan to open 50 additional stores in Japan within five years; and to develop a new warehouse of 12,500 m² in Athis-Mons (Essonne), combining the logistics of three initial sites and adding a laboratory for the production of prepared meals.

December 2018: The Japanese food distribution giant Aeon takes a 20% stake in the French bio store chain Bio c’Bon (2018 rev: €150m), which is owned by the French private equity house Marne & Finance. The chain currently operates 154 outlets, of which 64 are in the Paris region and 33 are abroad. Together the owners plan to open 50 additional stores in Japan within five years; and to develop a new warehouse of 12,500 m² in Athis-Mons (Essonne), combining the logistics of three initial sites and adding a laboratory for the production of prepared meals.

![]() September, 2018: The agricultural group InVivo acquires Bio & Co, a chain of six organic food stores in southern France, with annual sales of €22m. InVivo aims to have 150 Bio & Co food stores by 2025, as it looks to expand its retail business in the high growth organic segment. Most of the additional Bio & Co stores will be located next to InVivo’s existing gardening centers/ stores, which it believes is a complementary customer offering. The investment is also designed to support the handful of grocery outlets selling local products that InVivo has been trialling in the past two years under the brand, Frais d’Ici.

September, 2018: The agricultural group InVivo acquires Bio & Co, a chain of six organic food stores in southern France, with annual sales of €22m. InVivo aims to have 150 Bio & Co food stores by 2025, as it looks to expand its retail business in the high growth organic segment. Most of the additional Bio & Co stores will be located next to InVivo’s existing gardening centers/ stores, which it believes is a complementary customer offering. The investment is also designed to support the handful of grocery outlets selling local products that InVivo has been trialling in the past two years under the brand, Frais d’Ici.

March, 2017: The French private equity house Ardian acquires a majority stake in the French grocery chain Grand Frais. Grand Frais has earned itself the title of ‘category killer’ in the grocery retail business by focusing on quality fresh food at affordable prices, of which organic is a large part. Based in Lyon, the specialist retail concept has grown exceptionally well, with 15-25 new openings a year. The business currently has 185 stores, and an annual turnover of c. €1.1 billion. Grand Frais’s stores are located mainly on the outskirts of major cities and tend to be large, covering an average area of c. 1,000 sqm – a traditional indoor covered market, selling fruit & vegetables, dairy, fish and meat, as well as specialized grocery items. Suppliers are usually local and specialized.

March, 2017: The French private equity house Ardian acquires a majority stake in the French grocery chain Grand Frais. Grand Frais has earned itself the title of ‘category killer’ in the grocery retail business by focusing on quality fresh food at affordable prices, of which organic is a large part. Based in Lyon, the specialist retail concept has grown exceptionally well, with 15-25 new openings a year. The business currently has 185 stores, and an annual turnover of c. €1.1 billion. Grand Frais’s stores are located mainly on the outskirts of major cities and tend to be large, covering an average area of c. 1,000 sqm – a traditional indoor covered market, selling fruit & vegetables, dairy, fish and meat, as well as specialized grocery items. Suppliers are usually local and specialized.

*Source: Sprout Intelligence, 2017