- Home

- Publications & Actualités

- Why L’Oréal remains #1 in beauty…

Why L’Oréal remains #1 in beauty…

I’m happy to share Jean Paul Agon’s thoughts on the big questions facing L’Oréal, including the rise of Digitally Native Vertical Brands, growth through acquisitions, his views on e-commerce, digital disruption, the Chinese market, and the future of beauty.

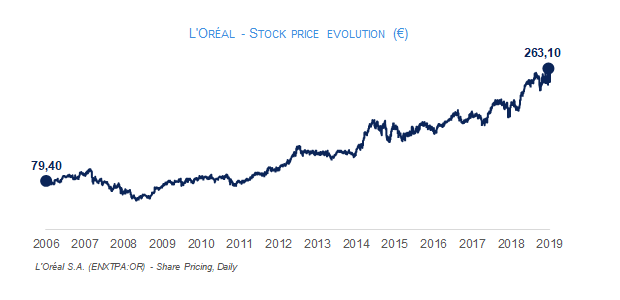

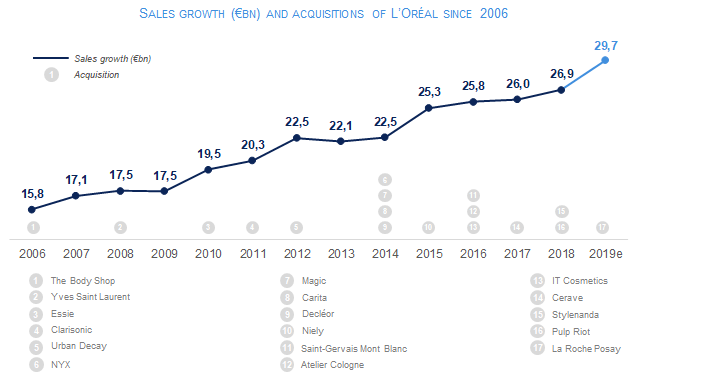

Since Jean Paul Agon became CEO of L’Oréal in 2006, revenues have grown by more than 3x and the stock price by more than 4x. According to Agon, the 112-year-old French beauty conglomerate has strengthened its position as the undisputed leader in the global beauty market due to a healthy appetite for acquisitions, as well as a robust and well balanced business model that covers all circuits, all categories, all price points and all consumers.

The below Q&A is taken from a collection of interviews conducted in 2019.

I – On M&A – growth through acquisitions:

“Our model is, and has been for 50 years, to buy a brand at an early stage because we think it can become a globally successful player. For example, we bought Kiehl’s in 2000, when the business was generating $20 million annually. It was a single store in New York City and had a few counters at Saks (department store). Then, for 20 years, we built the business and now it is a $1.37 billion business. The way we grow is exactly this combination of buy-and-grow – not buy or grow. And that’s what we do every year. Once the brands have been acquired, they are brands that we build.”

“We are looking every year at all opportunities, and we continue to do this. Make-up, skin care, hair care, hair colour – everything.”

“We currently have 35 international brands. L’Oréal is just one of them, but it’s obviously the one that we started with, and it represents around 25% of our sales. And, in fact, it’s the only brand that we didn’t buy.”

II – On e-commerce:

“There is a clear and very powerful movement towards e-commerce, which is very good, because it allows us to reach more consumers and it’s also pretty profitable.”

“E-commerce is currently about 10% of our total [global] sales, already almost three billion euros, so it’s not irrelevant. And it’s growing at 35% a year. We don’t see any slowdown in e-commerce beauty sales across the globe.”

“In China, where e-commerce is the most advanced, it’s huge – it’s more than 30% of sales.”

“With the new digital augmented services (which look at skin colour, hair colour and skin diagnosis) there is another tool to support online sales in the future.”

III – On digital disruption – in 2018, L’Oréal acquired Modiface, an ‘augmented reality’ company that digitally shows consumers the make-up they can wear. This is the first time that L’Oréal has acquired a pure tech company.

“We really believe that the future of beauty will be digital, and in this we are well ahead of the game. For us it is priority number one. In all aspects – social media, e-commerce, data, artificial intelligence. In terms of services, facilitating greater choice for consumers, helping them use products, individualizing products, etc. With digital, the possibilities become limitless. We are only scratching the surface of what will be possible.”

“Since we accelerated our digital initiatives we have seen profit margins increase, so there is a clear correlation between margin improvement and digital.”

“In the case of Modiface, the business case was obvious because this company is the best at what they do in terms of augmented reality, virtual simulation and obviously when you sell make-up, hair colour and skin care this capacity to simulate virtual reality is absolutely critical. It gives us a competitive advantage that is immense. Modiface helps all our brands to create new [augmented] services for consumers on their own sites or e-commerce sites. It is more an ROI thing, rather than a business itself.”

IV – On the future of beauty:

“The future is still about brands, more than ever. In a world of hyper choice and hyper segmentation, what consumers have on their minds in the end is brands. For example, when we acquire technology companies it’s not for business per se, it’s to serve the business.”

Source: https://www.loreal-finance.com/en/annual-report-2018/acquisitions-2-4/

V – On competition from new direct-to-consumer brands on social media platforms:

“It’s true that it’s easier for new brands to enter the market because the barriers to entry have disappeared. However most, or 99.9%, of the new brands that enter the market will stay small because the barriers to scale up still exist. And on the contrary, digital is boosting the power of big brands. Our biggest brands – Lancôme, Yves Saint Laurent, Armani, Kiehl’s, L’Oréal, Maybelline – have all had their best years ever in 2019.”

VI – On China:

“We started in China in 1997, which was a bit late as many of our competitors were already there. We started in an apartment with 10 people. (I was based there then as well.) And now I’m very happy to say that we are number 1 in China and China is a major part of our growth and business.”

“China has always been about skincare, compared to the rest of the world. Most people in China use a skincare product. So, number 1, skincare is still growing in China. But the interesting news is that consumers are now also going for make-up. Previously, make-up was very small in China, and 40 years ago it was almost forbidden. And now young consumers are excited about wearing make-up. And the lucky thing for us is that younger consumers in China are starting by going directly to luxury make-up brands. In a tier 3 or tier 4 city, it’s common for teenagers to go straight to the Armani or Yves Saint Laurent counter to buy their lipstick, mascara or powder. They are starting directly with more expensive products. It’s one of the reasons for the extraordinary boom we are experiencing in China.”

VII – On sustainability and ethics:

“We are recognised as a number 1 company on sustainability. The Carbon Disclosure Project (CDP), which is the authority in terms of the environment, awarded L’Oréal for the third year in a row the ‘AAA’ recognition. ‘A’ for forest, for water and for carbon impact.”

“When I took over as CEO, I understood that ethics would be something very important for the future. Again, I decided with the team that L’Oréal should be, and could be, the number one company in ethics. If you think about it, it’s not that difficult for L’Oréal to be a great company in terms of sustainability. Also, ethics is not really a problem in our industry. And gender equality also. We could have said, ‘it’s not difficult for us, let’s do something else’. On the contrary, what we said is, ‘it’s not that difficult, so let’s be exemplary, and be number one in the world’.”

[In 2019, L’Oréal was named for the 10th time as one of the World’s Most Ethical Companies. The Covalence ESG (Ethical Quote reputation index) also awarded L’Oréal the #1 ranking out of 581 of the largest listed companies worldwide.]

VIII – On the key shareholders of L’Oréal:

“We have two great shareholders – the Bettencourt family, who own 33% of the shares; and Nestle, with 23% of the shares. These large investors give us the possibility to think really long term, to be very strategic, and I think that it’s also part of the success of L’Oréal.”