- Home

- Publications & Actualités

- Impact of COVID-19 on LBOs

Impact of COVID-19 on LBOs

The impact of COVID-19 on LBOs and other debt financing structures

Uncertainties around the full impact of Brexit, the US/China trade war, the Syria crisis etc. already made planning for corporates difficult for the last few years.

The current COVID-19 virus has reduced visibility dramatically as evidenced by record high volatilities and the turmoil in all capital markets around the globe.

Global Economy

Undoubtedly this will have a strong negative impact on global GDP. Nearly all banks and research institutes are expecting global and domestic recessions and have adjusted their GDP forecasts accordingly. Fitch has nearly halved its baseline global growth forecast for 2020 to just 1.3% from 2.5% in the December 2019 Global Economic outlook. JP Morgan announced that US economy could shrink by 14% in Q2 and Goldman Sachs sees China’s economy slumping by 9% in Q1 2020.

For Germany, Deutsche Bank expects GDP to decrease between 4-5% in 2020 while Institut für Weltwirtschaft IfW Kiel forecasts minus 4.5% to minus 9% for 2020. ifo institute estimates that German GDP will shrink by at least 5.1% if the shutdown lasts for one month and by 20% if the shutdown lasts for three months and the recovery to full pre-shutdown levels takes 4 months.

Apart from a lucky few all sectors will be affected by a combination of eroding revenues, imploding margins and supply chain issues.

For corporate borrowers two immediate financing issues arise out of these dramatic developments:

- Highly reduced cash flow generation; and

- The risk of defaults under loan or bond documentations – either from financial covenant breaches or from other undertakings such as reporting obligations

Below, we have analysed the impact of shrinking revenues on financial covenants.

The Facts

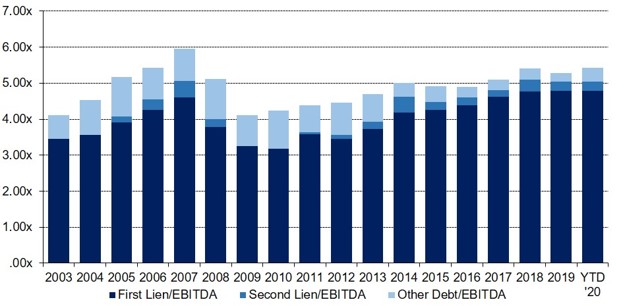

Senior leverages in European leveraged loans have risen close to all-time-high levels over the last few years:

![]()

Larger deals (typically larger than EUR 150m financing volume) were usually issued “covenant lite” and with bullet repayment structures. These financings do no not face financial covenant issues nor do scheduled repayments put immediate pressure on cash flows.

In contrast, (lower) mid-market financings (< EUR 100-150m financing volume) offered by bank clubs or direct lending funds still feature financial covenants, predominantly a leverage covenant. In addition, bank driven Term Loan A & B financing structures do foresee schedule repayments of the Term Loan A, usually on a semi-annual basis.

Similarly, non-levered syndicated loan agreements usually incorporate a leverage covenant of 3.0-3.5x EBITDA.

The Issues

In order to illustrate the impact of the current economic downturn we have run a scenario analysis for a standard lower mid-market borrower with the following base case KPIs and net debt:

- EUR 100m revenues

- 14% EBITDA margin (EUR 14m EBITDA)

- 20%/66% fixed/variable cost (EUR 20m fixed cost)

- Actual net debt at 5.3x EBITDA (EUR 74.2m net debt)

- Leverage covenant set at 30% headroom on EBITDA (covenant 7.57x EBITDA)

Scenario 1 – The GDP issue

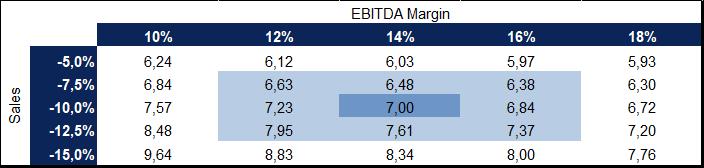

In a first scenario analysis we have run sensitivities on the company’s overall profitability (EBITDA margin) and sales.

![]()

Example: If revenues decline by 10% as projected more recently by research institutes (see above) and given the above cost structure actual leverage would increase to 7.00x EBITDA, i.e. still within the headroom and below the covenant of 7.57x. However, if revenues decline by 12.5% the company would be in default (leverage of 7.61x). Similarly, if the base case profitability would be just 10%, a sales decrease of 10% would result in a leverage of 7.57x EBITDA, i.e. just at the level of the covenant.

Scenario 2 – Why do fixed costs matter?

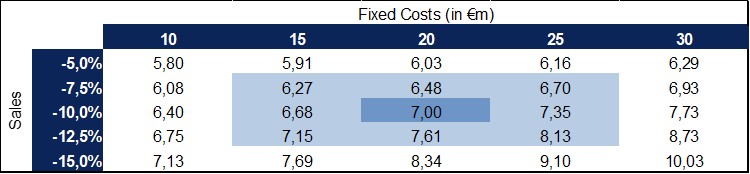

In a second scenario analysis we have run sensitivities on the company’s cost structure and sales:

![]()

As can be seen, leverage is even more sensitive to higher fixed cost levels. In our above base scenario fixed costs were set at EUR 20m. At a sales decrease of 10%, leverage would come out at 7.0x EBITDA, i.e. below the covenant. If fixed costs were to be set at EUR 30m (still with a base case EBITDA margin of 14%) a sales decline of 10% would already result in a breach of the leverage covenant at 7.73x EBITDA.

In a nutshell

The current shutdown of the economy does have serious impacts on highly levered companies. Under GDP scenarios suggested by leading research institutes, covenant headrooms will be eaten up quickly. Even more important, shrinking business does lead to liquidity issues.

Corporates are therefore strongly advised to prepare and to address these issues with their shareholders and lenders.