Industrial Technology Overview

During the last twelve months, financials markets have been thoroughly shaken by macro and microeconomic events. With no surprise, the Corona pandemic ranks highest. Nevertheless, the market capitalisation of the companies in the Global Industrial Technology Index returned to pre-Covid levels. This was based on a general market recovery, driven on one hand by strong economic growth in China and on the other hand by the continued low interest rate level and high pandemic support programmes in Europe and especially the USA. While the Industrial Technology index is already outperforming most of the main European Indexes, we see significant further potential.

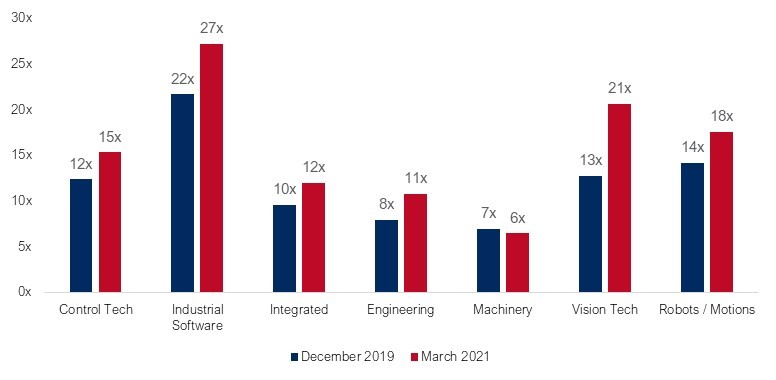

Valuations averaging 15.1x EBITDA, currently 32% higher than in December 2019.

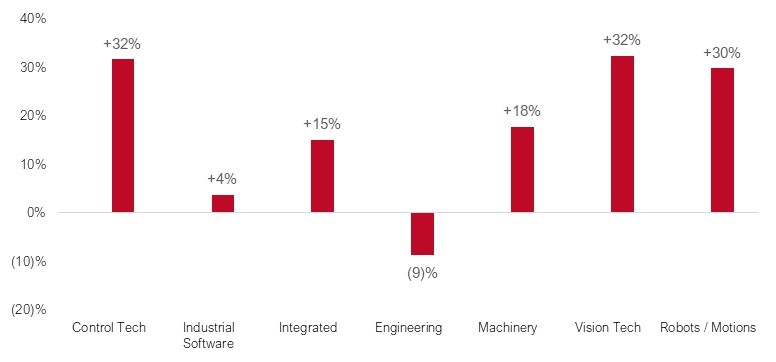

Multiples and equity values are currently converging, after market caps fell 30% by Q2 2020 and earnings expectations were disproportionately adjusted.

Net debt in 2020 is around 2% below the previous year. This is due to an 18.3% year-on-year increase in the liquidity level.

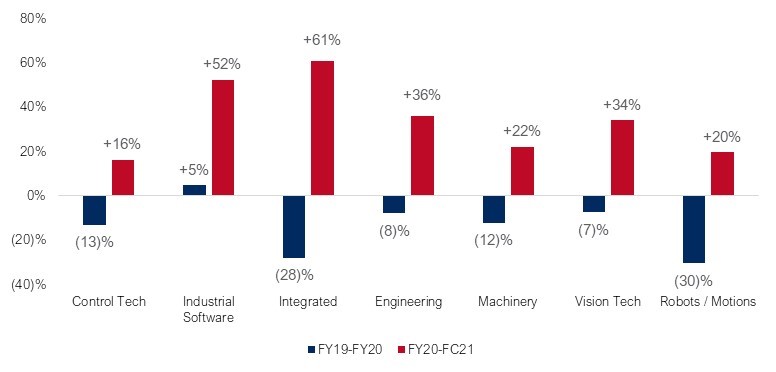

Strong growth is expected with regard to the development of EBITDA. According to consensus, an increase of 32% is forecast for 2021 compared to 2020, which is attributed to higher revenue growth and rising gross margins.

This growth will push the EBITDA level above the pre-Covid levels, which have shrunk by around 13% from 2019 to 2020.

Valuation drivers:

Automation and digitalisation have driven investment demand in pandemic-adjusted labour relations – at the same time, the supply has also revealed weak points.

The interlinking of individual value creation steps (from ordering, planning, through production to delivery), also on the software side beyond the MES, into the ERP has become more important than ever before than the top speed of individual « island machines ».

Customers demand holistic solutions for their « shop floor », with intelligent integration of upstream and downstream processes as well as manual activities.

EBITDA multiples by area (index 15.1x):

Development of market capitalisation by sector:

December 2019 – March 2021 (Index +19.1%):

EBITDA margin by sector:

EBITDA growth by sector 2019/20 & 2020/21 (index +31.9%):

Capitalmind Investec & Industrial Technology

The Capitalmind Investec Industrial Technology Index tracks daily developments in sectors such as Control Tech, Industrial Software, Integrated providers, Engineering, Machinery, Vision Tech & Robots/Motions.

The index includes valuations, growth projections, profitability margins and other metrics.