- Home

- Publications & Actualités

- Minority equity as solution to COVID-19 liquidity gap

Minority equity as solution to COVID-19 liquidity gap

Minority investments on the rise in the short-run as private companies seek funding to overcome the COVID-19 crisis

The COVID-19 liquidity gap

The financial impact of the sudden COVID-19 pandemic is already severe in many businesses facing extremely low or no activity at all. Naturally, this will quickly lead to a liquidity shortage. As the full economic impact of the current global COVID-19 outbreak remains unpredictable, governments place their trust in aggressive fiscal and monetary policies as well as flexibility from the established banking system.

However, in many cases this is likely to prove insufficient:

- Businesses are already facing short-term liquidity issues, and the length of the crisis remains highly uncertain. Financial planning is close to impossible.

- Government support packages help in the very short-term, but only partly.

- The banking system is rigid and scared of the last financial crises. They will be reluctant towards more exposure, also due to rapidly increasing debt-to-EBITDA levels as a result of lower business activity.

- Even if the strategy will help companies survive, in many cases the businesses will still be forced to cut back investments for several years to recover and regain the same financial strength.

Therefore, many business owners need to search for more flexible solutions to maintain their position on the market towards suppliers, customers, employees, etc.

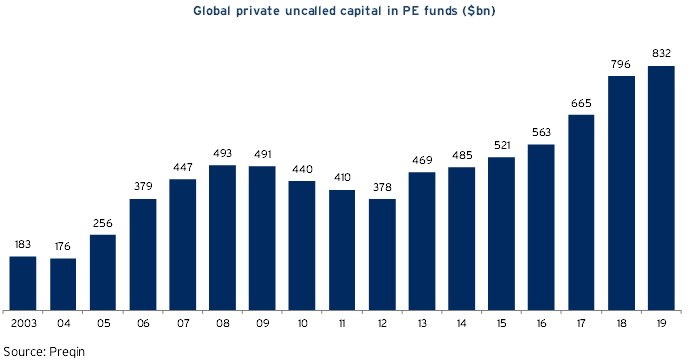

Private Equity funds are piling up cash

Private Equity firms provide flexible funding solutions and have all-time high levels of available funds (“Dry powder”). At the end of 2019, global buyout funds had a total of $832bn in uninvested committed capital, of which European PE funds account for one quarter. PE firms are now looking to allocate this capital to businesses with a solid plan and robust operations.

Minority equity partners as a solution to COVID-19 liquidity gap

Then adopting a long-term perspective, it is essential for management teams to have enough funding to manage their businesses based on long-term value creation rather than being limited to focus on short-term survival. This applies during the initial shutdown period, but to an even larger extend afterwards when the activity starts to normalize. Opportunities will arise for healthy companies to reshuffle cost structure, launch new product programs, or pursue acquisition opportunities.

As an example, one of Capitalmind Investec’s sell-side processes was last week turned into buy-side engagement, where we will utilize our international presence to support our client in building an even stronger geographically diversified business before going to the market again.

“It is a huge advantage that our client has the financial strength to pursue opportunities right now.”

– Stig Madsen Lachenmeier, Managing Partner at Capitalmind Investec

Private Equity sponsors would be a natural way of securing such flexibility. On the other hand, in the current phase of turmoil valuations will expectedly come down, which makes the timing of inviting a new majority owner into a company challenging. Therefore, financial sponsors who provide equity injection for a minority stake is likely to provide a highly attractive solution, because:

- Valuation is less sensitive since a smaller stake is sold/issued. Additionally, preference share mechanisms can be used to mitigate valuation issues.

- The existing shareholders maintain control of the company while reducing their own risk.

- The minority investor will provide the necessary short-term liquidity to pursue business opportunities arising following the crisis.

There are several Nordic PE funds and family offices doing minority investments in well-driven companies of different sizes (such as IndustriUdvikling (DK), VIA Equity (DK), Kirk Kapital (DK), Priveq (SWE), REITEN & CO (NO), Investment AB Spiltan (SWE), and Formica Capital (SWE)). Larger companies could also attract investments from international minority and special situation PE funds (such as Intermediate Capital Group (UK), H.I.G. CAPITAL (UK), and Mimir Invest (SWE)).

At Capitalmind Investec, we expect these PE investors to constitute an attractive funding solution for many family- and management-owned SMEs in the coming period.