- Home

- News & Insights

- Insights from industry leaders highlight M&A TIC sector strength

Insights from industry leaders highlight M&A TIC sector strength

The Testing, Inspection & Certification (TIC) sector is in robust shape, judging from discussions at Capitalmind Investec’s second annual European TIC Conference (March 2024). Personal experiences shared by the heads of two highly acquisitive TIC businesses offered the audience of 60 industry leaders valuable insights into current Mergers and Aquisitions (M&A) thinking and trends.

The event kicked off with an overview of the state of the M&A market in the TIC sector. Capitalmind Investec has built up many years’ experience providing mid-market TIC companies in the UK, Europe and US with M&A financial advice.

Marleen Vermeer, Partner at Capitalmind Investec, highlighted the growing shift towards a global focus in M&A activity. “Until a few years ago, TIC M&A activity was generally domestically oriented. That is now changing quite rapidly with more cross-border transactions,” she said.

Watch and read the highlights from our European TIC conference

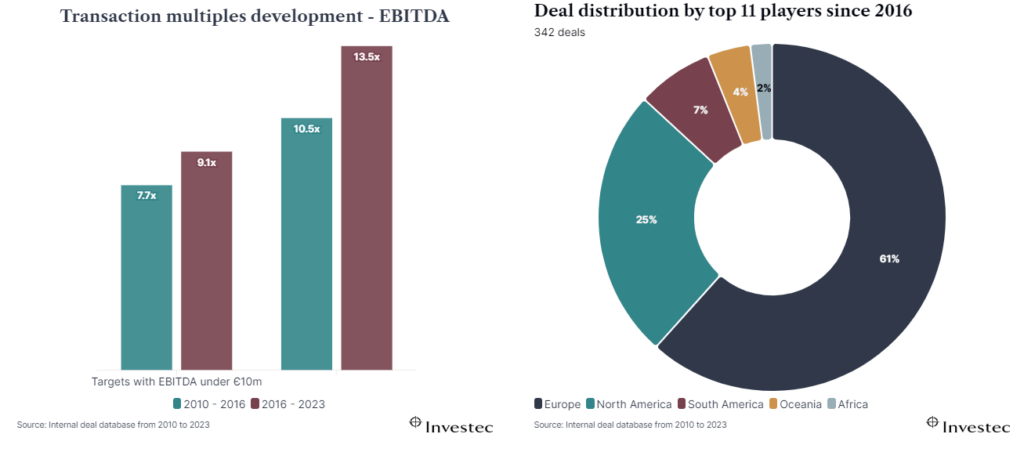

Acquisitions and organic growth

Higher levels of M&A activity than is generally seen in the market are being supported by stable company valuations and high exit EBITDA multiples, as Michel Degryck, Managing Partner at Capitalmind Investec, explained: “We saw a rise in valuations from 2020 to 2022 and they are now more stable. Investors are increasingly paying close attention to organic growth in TIC businesses. Generally speaking, a good valuation multiple requires double-digit organic growth. Companies must also demonstrate that their acquisitions can grow fast to prove they will generate value on top of providing relative multiples.”

Continued consolidation trends, with valuation expansion

In the current economic climate, trade buyers of TIC companies are also keeping a keen eye on pricing power. “The ability to pass through inflation cost by increasing prices is important to potential buyers. Businesses that offer more than just pure TIC services tend to succeed better in passing on higher costs,” Michel noted.

Sustainability, digitalisation and internationalisation

Marleen outlined three important trends in the sector: sustainability, digitalisation and internationalisation. “Investors are looking for sustainability and TIC companies are benefiting from growing societal expectations for a safer, more sustainable world,” she observed. Capitalmind Investec predicts that digitalisation, particularly connected devices and remote services, is changing TIC businesses, said Michel: “TIC companies are looking at how they collect and leverage data, and at using artificial intelligence, to provide their clients with more business value. As a result, TIC companies are moving from ticking boxes to check compliance with regulations to providing risk management solutions and business performance tools.”

Internationalisation was evident in the success stories recounted by France-based Trescal, the global leader in calibration with a busy buy-and-build investment strategy, and Netherlands-based Normec, a rapidly growing TIC company.

Until a few years ago, TIC M&A activity was generally domestically oriented. That is now changing quite rapidly with more cross-border transactions.

Marleen Vermeer, Partner at Capitalmind Investec

Trescal: don’t rush acquisitions

Guillaume Caroit, CEO of Trescal, said around one-quarter of annual turnover growth came from organic growth and the rest through acquisitions. Impressive expansion into 30 countries, with over 5,000 staff and 70,000 global customers is the result of combining caution with ambition.

Guillaume’s advice for an effective M&A strategy is “Don’t bite off more than you can chew. And don’t rush things too much.”

M&A activity helps Trescal to maintain its preferred balance between end-markets as well as diversifying into new geographies. Guillaume said private equity firms were supportive of the strategy. “PE firms like the purity of Trescal as a pure player in calibration which is our core business, plus our ability to attract good managers, especially in new countries.”

Chief among his priorities when integrating businesses is to invest in people. The Trescal Institute supports the retention of skilled technicians and engineers post-acquisition by offering training programmes. “Many of our competitors can’t afford to invest as much as us on people,” said Guillaume. “We train people centrally in Paris and recruit locally around the world.”

Normec: focus on countries and sectors

Joep Bruins, CEO of Normec, set up the company in 2015 and immediately began buying small TIC companies. Normec focuses on only four TIC sectors: food, life safety, sustainability and healthcare. About half of its business comes from acquired companies.

“We have a one-stop delivery model for clients to access all types of labs to meet their needs,” he said. “We also offer label compliance and software development services, so they can receive everything from a single supplier.”

Normec’s organic growth is over 10% and it has made over 60 acquisitions to date. This buy & build strategy has been funded by private equity funds since around 2017.

The company’s geographic spread is currently nine countries. “We try to stay as focused as possible in our core sectors and countries,” said Joep. “Our clients are relatively small and many don’t necessarily need international services. Three-quarters of our revenue comes from small- to medium-sized businesses.”

Once a target is acquired, Normec doesn’t look to relocate or centralise the business. “We keep acquired companies where they are, so we have local labs offering high service levels. It’s fairly easy to integrate them into our wider network. Here, colleagues can learn from each other.”

TIC talking points

To round off the conference, Ed Thomas, Managing Director, UK, at Investec, quizzed Guillaume and Joep, along with Charles Welham, a Partner at asset fund management group Bridgepoint, on how TIC M&A activity is changing.

What are the challenges of internationalisation?

Scaling up activities should be a priority, said Charles: “You shouldn’t look at internationalisation for the sake of it. You need to have in place a team that can scale up in different countries, and this gives you a local presence if things go wrong. It helps to focus on just part of the TIC market, rather than buying everything that’s going.”

Joep emphasised understanding the culture and looking for similarities in acquisition targets. “For me, differences between countries are not as big as differences between individual people. Scaling your business as you acquire is as much a question for your Human Resources as your M&A team.”

Guillaume agreed that a personalised approach is essential. “We do the basics and get a cultural understanding of new countries, like Thailand and China. The calibration sector is so niche that target companies probably know us already, which helps.”

What lessons have you learned?

Having a regionally based group structure is important for Trescal. “Previously everyone reported to me; now we have four regional areas with their own P&L reports and steering committees. It helps us manage local issues more effectively,” said Guillaume.

Maintaining a strong local presence is something Bridgepoint learned the hard way. “Local people often want to speak with local deal originators. We’ve gone wrong on larger deals in new countries by not having done enough commercial due diligence or understanding national regulatory changes,” said Charles.

Organic growth or M&A?

Both Joep and Guillaume highlighted the difficulty of ‘doing it yourself’. Joep said: “Organic growth is very hard. For a start, your labs need to be accredited as well as every test you conduct. That can take one or two years. If you want to grow quickly and scale a business, then M&A is a better way.”

Guillaume agreed: “Creating a ‘green field’ operation takes too long. We have opened a number of our own labs in the last 20 years and ended up shutting most of them down.”

What’s your outlook for TIC M&A?

“Trescal is looking to grow in the Asia-Pacific region and has its eye on China, India and Japan” said Guillaume.

For Joep at Normec, it’s a question of “keeping on doing what we’re doing.”

Bridgepoint expects M&A activity to continue at pace. “There are so many acquisition opportunities in the TIC sector. It’s a true technical sell, which is why we like it so much,” said Charles.

The panel also fielded audience questions on rebranding acquired companies, typical deal execution timeframes, how to support target companies that are not yet investor-ready, and the trend towards consolidation in the TIC market.