- Home

- News & Insights

- TIC sector dominated by European buyers

TIC sector dominated by European buyers

With Europe still being the dominant M&A geography in the TIC market (48% of the targets acquired in the last decade were located in Europe), North America is the second largest region (34%) . A large part of the buyers who acquired a business in North America are headquartered in Europe.

North American TIC market

The North American TIC services market is estimated around $ 30bn and is projected to grow by a CAGR of 6%. The growth is related to stringent government regulations and standards in the US. Globalization has led to an increase in global trade agreements, resulting in the growth of TIC services for production companies that need to comply with international standards. Among the main growth drivers of the US TIC market are the growing demand for tech-enabled TIC solutions, popularity of IoT and rise in emphasis towards reducing equipment and machinery downtime (asset management). Moreover, in February 2019, the U.S. FDA announced a new strategy for monitoring and inspecting food imports. Besides, the growth is a result of increased outsourcing of TIC services due to the fact that it becomes more complicated, technical and cost effective, for companies to perform these tests in-house due to the stringent regulatory standards.

Transactions with a US target involved

The testing market has dominated the North American TIC market with 65% market share, related to the growing concern among consumers regarding the quality of products. This is also visible in the type of transactions with a US target involved. Also 65% of all transactions with a US target involved where laboratories and other Testing activities, compared to 18% in Inspection and 4% in Certification (remainder of the transactions where consultancy/training/software related). Since certification services is actually the largest growing market in the US, by a CAGR of 9%, we expect a shift here in number of transactions per business line, although certification will still remain a small segment and pure certification players are rare.

Some examples of recent transactions in the US are:

Beginning 2020, SGS acquired Thomas J. Stephens & associates inc.. Stephens is a nationally recognized clinical research organization serving the cosmetic and personal care industry. It is a leading provider of safety & efficacy testing and contract research services, generating $ 15m in revenues. This acquisition expands SGS’s Consumer & Retail service portfolio in the clinical testing sector for cosmetic and personal care products in the USA.

In 2019, Socotec, a leading European company of testing, inspection and certification services, #1 in technical control in the construction field in France strengthened its international position by acquiring Vidaris in the US. Vidaris is a provider of specialty consulting services within the architecture, engineering and construction industries focusing on high-performance buildings and specialty structures. Through an integrated, holistic approach, our professionals provide solutions for building envelope, energy efficiency, sustainability, dispute resolution, code compliance and construction advisory projects. Vidaris employs over 300 professionals in 15 offices.

In 2018 Bureau Veritas completed the acquisition of EMG Corporation (EMG), a US leader in construction technical assessment and project management assistance, asset management assistance and transaction services, generating € 70m in revenues. A more recent transaction in 2019 was the acquisition of Owen Group. Owen provides buildings and infrastructure asset management and project compliance services including ADA accessibility compliance, deferred maintenance compliance, commissioning, and code compliance, generating around $ 7m in revenues .

In 2019 Dekra has expanded its mechanized and industrial inspection business in the United States through the acquisition of JAMKO’s business operations based in Lyons, New York. JAMKO specializes in remote mechanized visual inspection in nuclear and municipal markets.

Eurofins acquired Test America end of 2018. Test America, which became part of JSTI through its acquisition in September 2016, operates an integrated network of 24 full service testing laboratories and 40 service centres throughout the USA, generating over $ 230m in revenues. Test America expanded the footprint and complement the service offering of Eurofins’ Environmental Testing Business in the USA.

We also see more Tech-enabled TIC companies being acquired. In 2018 for example Intertek expanded its global Assurance business with the acquisition of Alchemy, a leading provider of SaaS-based People Assurance solutions for a total value of $ 480m.

Buyers mainly from Europe

In general the majority of the large TIC players are headquartered in Europe. As you can see in our recent Insight blog (TIC Industry shows considerable M&A activity as growth & innovations stimulator) Eurofins and SGS are the leading acquirers in terms of number of transactions.

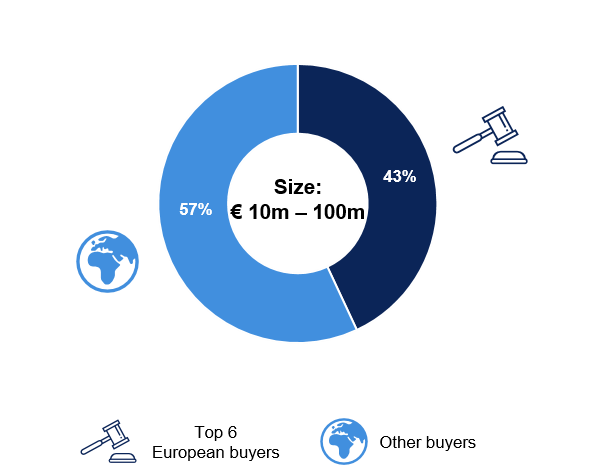

The top 6 European buyers were responsible for 43% of the transactions with a US target involved

(as % of all deals with US targets of which revenue size was known).

Based on our database including over 1,600 TIC transactions over the last decade, almost 500 transactions were deals involving a US based target. Of these 500 transactions over 100 targets were acquired by the large European TIC players, Eurofins and SGS being the leading buyers with 31 acquisitions in the US versus 29. Bureau Veritas, Dekra, Intertek and Applus were also actively looking overseas for interesting US based targets.

Relatively seen, the large European TIC players were involved in a US based acquisition in up to 24% of their transactions closed. We see that this percentage is much higher for larger transactions, around 40 to 50% for acquisitions of targets between € 50 and € 100m revenues. For the coming years we expect an increase in the number of deals with a US based target involved. Several companies mention North America as one of their priorities. Bureau Veritas explicitly mentions “expansion in North America is a priority for the Bureau Veritas 2020 Strategic Plan. Today in North America, the Group has over 7,500 employees and generates 15% of its total revenue”. While Eurofins states “Eurofins provides the North American market with complete analytical solutions supported by a commitment to excellent customer service, high-quality standards, and scientific expertise. Our objective is to be the bioanalytical company of choice in the US”.

Extra rationale behind transactions for European buyers

EEuropean buyers have an important rationale and driver behind a transaction in the US. A recent study based on 2019 transactions, shows that in 46% of the cases entry into new markets is an important driver behind the acquisition. This applies to the TIC market as well, where the large European players prefer entering a new (US) market via a Buy&Build versus organic growth. The study shows another reason in 41% of the cases: acquiring know-how or a team as the rationale behind a transaction.

US-based TIC buyers

Another interesting conclusion is that there has been relatively more PE involvement in acquiring TIC companies in the US compared to globally. In over 11% of deals with a US target, a Private Equity firm was the buyer versus 8% of the deals when looking at all TIC transactions on a global scale.

One of the largest buyers is US -based UL. The majority of the targets UL acquired were located in the US (51%) and mainly focused on Building & Infrastructure and IT segments. Although UL looks for targets overseas as well, like the recently acquired UK-based Wintech, that offers testing and certification services for the building and construction industries.

The more specialised TIC company Food Chain ID, owned by PE firm Paine Schwartz Partners acquired several Food TIC businesses, like the acquisitions of Diversified Laboratories and Decernis. They also look overseas to acquire businesses, like the acquisition of Quality Partner in Belgium mid-2018 and 6 months earlier an acquisition in Italy (Bioagricert).

A more hybrid example of European/US initiative is the recent $1.8 billion investment in 33% of the shares of the European TIC company Socotec (backed by Belgian family office Cobepa) by New York based Private Equity firm Clayton, Dubilier & Rice.

Sources: Capitalmind Investec proprietary TIC transaction database, Graphical Research, Global Market Insights, Business Wire, CMS