- Home

- News & Insights

- VisionTech: Q2 update & outlook

VisionTech: Q2 update & outlook

External effects on industry and valuations

With regard to the robotics and automation industry in general, we see a twofold situation: on one side the industry reports a boom in demand – in Germany the order intake January to April increased by 38% compared to previous year. The dynamic market development was already indicated in the 2021 results. However, with first signs by the end of Q1/2022, orders cannot be processed and converted into revenues as quickly as usual. One of the main challenges now is to manage supply chains.

Accordingly, the industry forecast 2022 still shows growth (+6% in revenues), but with a lower rate than predicted by end of 2021, reflecting severely disrupted supply chains. Market participants report about shortages especially in electronic components lengthening delivery times. Overall, VDMA expects a market volume of EUR 14.4bn, which is now slightly below the pre-Corona level in 2019 (EUR 14.7bn) and same level as 2017. Following a 16% growth in 2021, the machine vision sub-sector expects to grow by only 5%.

From an economical perspective the vision tech sector faces a bundle of challenges which might never have been bigger in the last decades: Corona pandemic and the Ukraine war burden the industry with effects such as supply chain disruptions, increase in energy prices and rising interest rates. Specifically in Germany another topic is looming around the corner in addition: companies are facing a shortage of labour and skilled workers, which is accelerating due to the coming retirement of the “baby boomer” generation. At the same time offering another strong argument for the future potential of robotics and automation, it might need political commitment for offering attractive perspectives for skilled workers from abroad.

Long-term, aspects that we already mentioned previously still appear to offer attractive growth potential for the automation industry, including its vision & sensors subsectors:

- New technologies support and secure the requirements and quality standards for sustainable high-tech production.

- Human-robot collaboration or the use of assistance systems creates higher quality employment and offers new opportunities for education and training. E.g. in the vision industry, we see AI powered, autonomous systems coming up that can be used “plug & play” without programming and intuitively.

- IIoT, AGV (automated guided vehicles) and AMR (autonomous mobile robots) are some of the few remaining fields to form truly integrated systems in the smart factory.

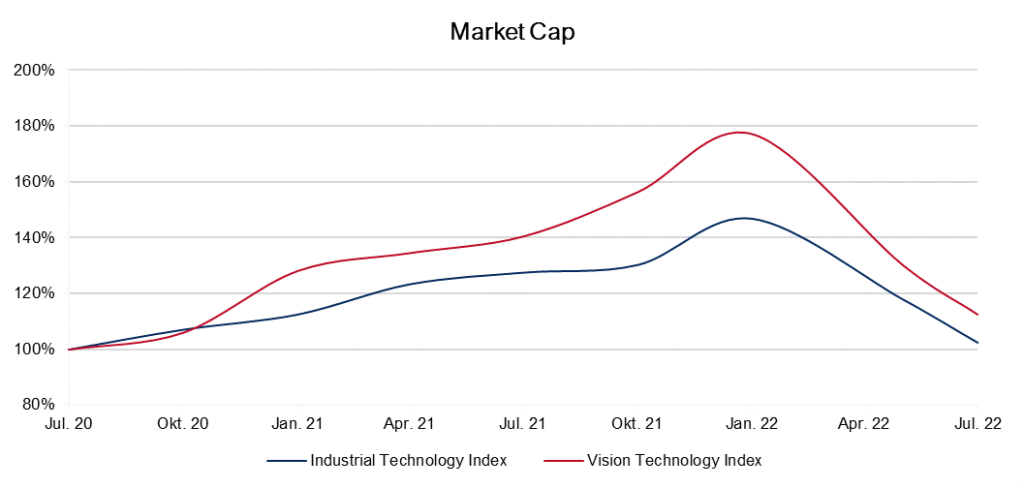

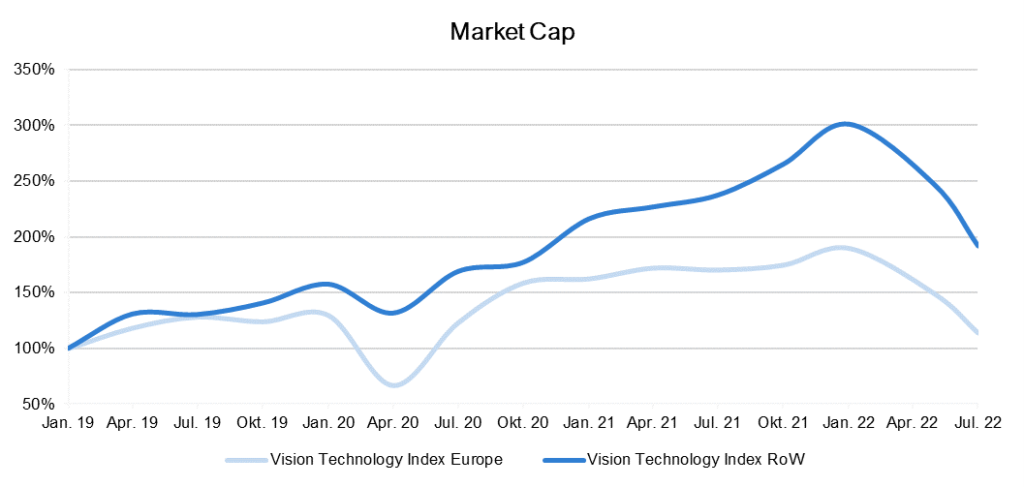

In terms of valuation, the above mentioned economical developments already imposed a significant effect to the economy in general and so they have on the vision tech industry. Having shown a better development in market cap and EBITDA multiples in many phases of time during the last 3 years, the vision tech companies in our Capitalmind Investec Technology Index have suffered disproportionately during Q2/2022.

Interesting to see, that although the Ukraine war might be regarded as a predominantly “European crisis”, the European based companies have shown a bit of relatively stronger (i.e. less weaker) development than the “RoW peer group”, which is dominated by US companies.

Short/mid-term we keep expecting some pressure on (stock market) valuations, as higher costs for input factors such as raw materials, preliminary products and supplies, especially energy, as well as rising wages and salaries put margins under pressure. This underlines the importance of “pricing strategies” in the current environment to reduce effects on earnings level and on enterprise value subsequently. Same goes for interest rates reflecting the cost of capital. However, despite the increase in recent months, financing costs are still low from a historical perspective. In the current environment, company sellers can still make good succession arrangements and still secure relatively high valuation levels. Medium to long-term we assess the upside potential of the industrial tech sector including automation and vision tech as considerable.

The Capitalmind Investec Industrial Technology Index tracks daily developments in sectors such as Control Tech, Industrial Software, Integrated Providers, Engineering, Machinery, Vision Tech & Robots/Motions.

The index includes valuations, growth projections, profitability margins and other metrics. You can find more information on our website at https://capitalmind.com/industrials/

Capitalmind Investec has got a senior sector team in Technology and we are experienced experts in selling, buying and financing businesses.

If you have questions and would like to know more about valuations, buyer activity and current opportunities in the market – please get in touch: arne.laarveld@capitalmind.com