- Home

- Publications & Actualités

- Vision & Automation update

Vision & Automation update

Valuations and M&A activity rebounce

Catching-up from our last Insight, we have seen many companies, both private and public, report excellent results for 2022. Some obstacles like supply chain disruptions and other pandemic effects have eased. Inflation, energy prices, additional effects of multiple geopolitical crises as well as the shortage of skilled work force still have to be considered as risks to the economic development and a recession scenario is not fully off the table. With a market volume of € 14.3bn in 2022 for the German robotics & automation industry, VDMA’s forecast (14.4) was only slightly missed, in 2023 the industry expects a significant 9% growth supported by processing the high order backlog and the continuous high level of demand for innovative automation solutions. This would represent a market volume of €15.7bn, exceeding the pre-pandemic revenue peak (15.1) in 2018.

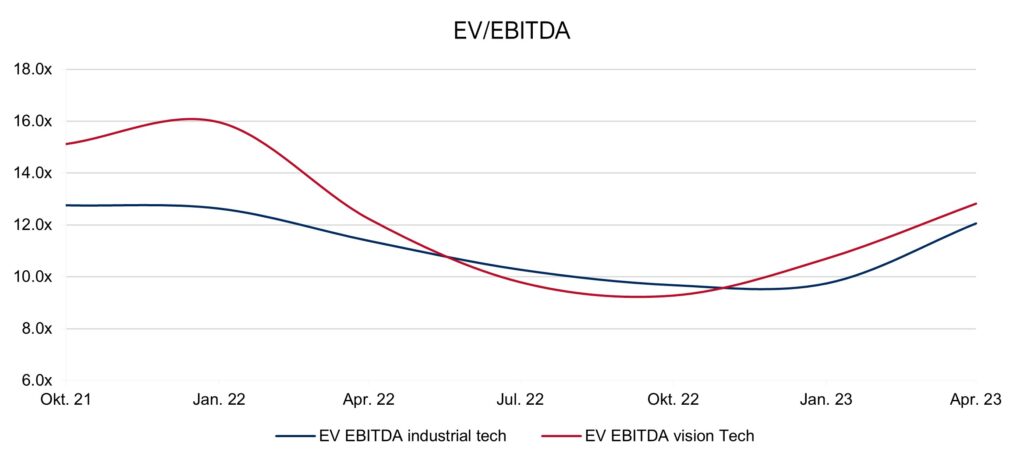

Following the overall stock market recovery since end of 2022, the Capitalmind Investec industrial tech indexes show EV/EBITDA levels back above 10x. It is interesting to observe that vision technology valuations showed relative strength compared to the overall index and are slightly higher. Again, as one would have to note, the lower than the general industrial tech index valuation for vision tech companies from July to October 2022 indeed was a rare exception in the recent past.

This picture is supported by the development of EBITDA margins of vision tech companies, showing a step back to levels of around 20% since 2021.

Despite challenges on multiple ends, there has been a decent number of vision tech related transactions in recent months. Apart from intra-European transactions both from strategic and financial sponsors (e.g., Antares, Marchesini, TKH, Avedon Capital, Ambienta) it should be noted that there was a good level of acquisition interest especially from US strategics in European service and technology assets. Active players included Bruker, Panacea Technologies, Microvision or Cognex, which acquired SAC Sirius Advanced Cybernetics, a transaction in which Capitalmind Investec advised the SAC shareholders in the sale.

Despite risks, which continue to exist, like geopolitical tensions or inflation from our discussions with market participants we take away the continuous high level of interest in attractive assets, which is based on long-term trends supporting the demand for innovative automation solutions in digital transformation or to cope with demographic developments, skilled workforce shortages and the need for more efficient and sustainable production.

Snapshot – SWIR imaging

Taking up our comments regarding hyperspectral imaging, we would like to share a few interesting perspectives recently provided by Yole about SWIR imaging. Although, still to be considered as a niche market with a bit more than 10k units sold globally, Yole estimates SWIR imaging to show a substantial above the market growth rates until 2028, supported by mainly three sectors: the industrial segment (CAGR 2022-2028 28%), due to demand development and price reductions. Second, the defense industry showing a CAGR of “only” 10%, now higher than in the last estimate (3%), as on the back of geopolitical tensions countries are expected to increase their military budgets and become interested in SWIR technologies. The biggest push is estimated to come from consumer applications, as from 2026 onwards, SWIR can probably start replacing NIR imagers in premium smartphones for under-display integration of facial recognition modules. This might drive a $2,074m market by 2028 (CAGR 2022-2028 86%). Currently, several emerging technologies compete to reach cost and performance requirements of large end markets. Besides the established players in the sensor and vision space there are a number of smaller players following different approaches (quantum dot, organics, Ge-based) who could attract M&A interest e.g., by large scale CIS suppliers.

The Capitalmind Investec Industrial Technology Index tracks daily developments in sectors such as Control Tech, Industrial Software, Integrated Providers, Engineering, Machinery, Vision Tech & Robots/Motions. The index includes valuations, growth projections, profitability margins and other metrics. You can find more information on our website and specific industry insights in our latest Systems Integration Report.

Capitalmind Investec has a senior sector team in Technology, who are experienced experts in selling, buying, and financing businesses.

If you have questions and would like to know more about valuations, buyer activity and current opportunities in the market – please get in touch: arne.laarveld@capitalmind.com