Case Study Sale and Leaseback of Corporate Real Estate Purchase Price 20% +

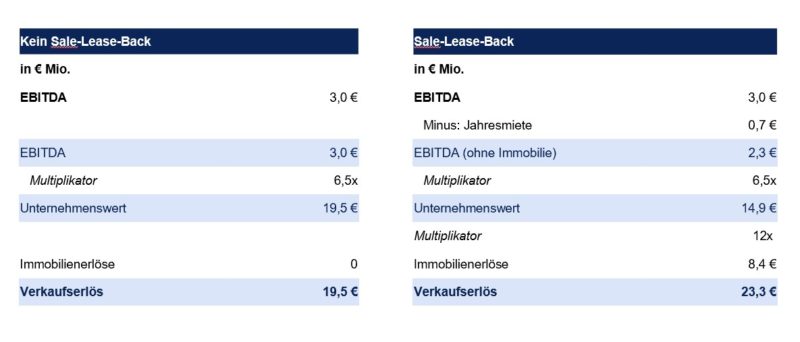

Frequently, medium-sized companies fail to realize the value of the real estate in the context of a total sale and forego significant economic benefits. As the example “No sale-leaseback-back” below clearly shows, the EBITDA multiple applied by the buyer does not value the company’s real estate at its market value.

Also, a company with business premises is often less attractive for the buyer. In contrast to medium-sized companies, international listed companies and those in private equity ownership try to avoid tying up capital in real estate to a large extent.

Offer becomes more attractive through lower capital commitment and flexibility

Owners can therefore make their offer more attractive to a broader group of buyers by selling the property in the run-up to a transaction or parallel to it, for example to investors and/or real estate financiers specializing in corporate real estate.

High economic advantages reward the additional effort

In this example, we were able to achieve approximately 4 million (20%) higher revenues for one customer. Although the transaction was somewhat more complicated, the economic benefit shows that the effort was justified and that it was worthwhile.

Also, a financing alternative

In the case of refinancing, restructuring and growth and acquisition financing, the sale and lease back of real estate must be examined for its advantages. Please read our article “Sale & Lease Back as a financing alternative”.