Business Services Overview

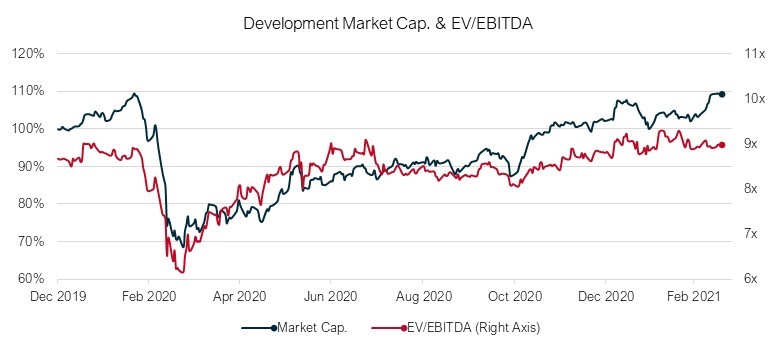

A good year after the outbreak of the Corona pandemic, the market capitalisation of the companies in the Global Business Services Index reached pre-crisis levels. In addition to a general market recovery, an increased interest of investors in value companies can be noted. Compared to the evolution of several main European indexes, we see further potential in the market capitalisation of the companies in the Business Services Index.

The development of company valuations in the business services sector has also been positive in recent months. The Corona decline was fully recovered and even surpassed. The current valuation multiples of 9.0x EBITDA represent growth of 3.5% since December 2019 (8.7x).

FY20 Net debt levels are 9.6% lower than in FY19, foremost driven by increasing Cash Balance of 27.1% as compared to the precedent year.

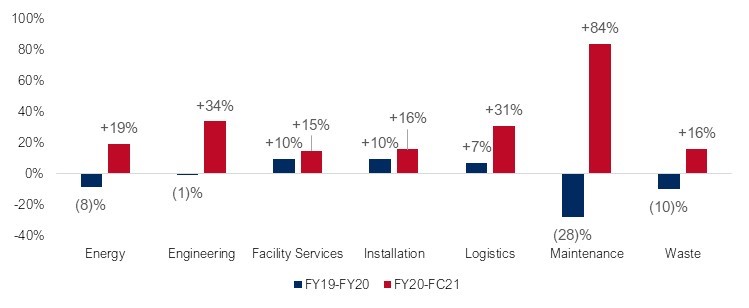

Strong growth is expected in the development of EBITDAs. For 2021, consensus forecasts a 25% increase compared to 2020, which is attributed to higher revenue growth and increasing gross margins.

Valuation Drivers:

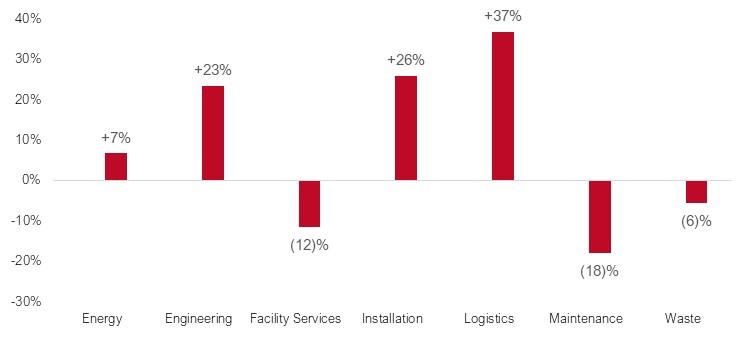

The accelerating digitalisation trend is having an overly positive impact on sectors such as Logistics, Engineering and Installation due to the faster adaptation of new technologies such as BIM (=Building Information Modelling) and AI-supported automation within distribution centres.

Market capitalisation by sector December 19 – March 2021 (index +8.7%):

EBITDA growth by sector 2019/20 & 2020/21 (index +24.9%):

Capitalmind Investec & Business Services

The Capitalmind Investec Business Services Index tracks real-time developments in sectors such as Energy, Engineering, Facility Services, Installation, Logistics, Maintenance and Waste.

Our Index includes valuations, growth projections, profitability margins and other metrics.

Would you like to learn more about valuations, buyer activity and current opportunities in the market?

Feel free to contact us.

Find out more on our website at https://capitalmind.com/ business-services/