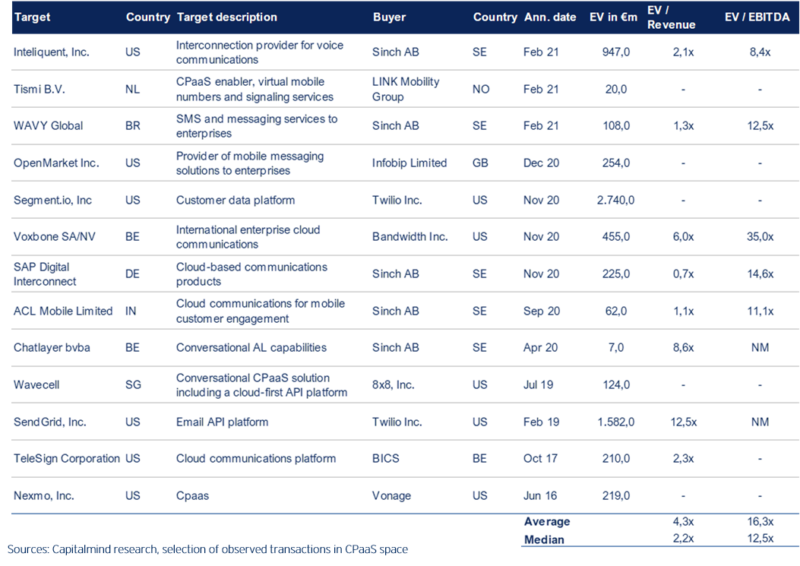

High M&A activity & consolidation in CPaaS market

There has been quite some M&A activity in the Communications Platform as a Service (CPaaS) market. The last five years, leading CPaaS players have been competing for market share by engaging in numerous acquisitions on global scale. Companies such as Twillio Inc, Vonage and Sinch AB are examples of companies that have rapidly been expanding (internationally) by consolidations.

CPaaS market is expected to register a CAGR of 34.3% during the forecast period (2020 – 2025)

The CPaaS market is highly competitive, primarily small and large vendors in the market conducting business in domestic and international markets. Under the current CPaaS 3.0 proposition – which is currently in full bloom – the leaders of the core CPaaS segment are moving beyond the delivery of basic API functions.

Leading companies are raising capital to pursue M&A strategies and strong growth

- In 2020, Infobip raised over $200m from private equity firm One Equity Partners at a valuation of over $1bn. It was the company’s first external round of funding.

- Sinch raised $690 million from SoftBank in December 2020 to fund further acquisitions.

- MessageBird raised $200 million in Series C funding in a round led by Silicon Valley’s Spark Capital – at $3 billion valuation.

- Number of mid-sized players went through successful IPO – Link Mobility Group, Route Mobile, CM.com

Diversified CPaaS Buyers

Despite numerous acquisitions in latest years, the market appears to be fragmented, with key vendors adopting major strategies like product innovation, mergers, and acquisitions to widen their product functionality and stay competitive.

M&A rationale

According to Gartner, CPaaS vendors are rapidly expanding their product scope to target a wider range of use cases in an increasingly competitive environment.

This segment is becoming increasingly consolidated, led by a few large players, followed by a robust band of midsize companies and a long tail of smaller companies. However, this segment will continue to evolve as companies like Microsoft and Cisco and network operators like AT&T gain traction and provide additional competition.

We find that acquirers look for:

- Enriching platforms to be fully programable across the modalities

- Improving customer engagement

- Boosting KPIs, connectivity and technical capabilities

- Enhancing messaging and API capabilities

- Expanding geographically / Entering new markets

- Acquiring customer base

To access and read the market report click here

For enquiries, please contact: ron.belt@capitalmind.com