- Home

- News & Insights

- Financing Market Update – The Perfect Storm

Financing Market Update – The Perfect Storm

Current market conditions are affecting the use of classic financing options and opening a market for alternative financing products. In this Insight we explain why these can be more attractive for companies and why it is helpful to involve an advisor.

1. Global uncertainty paralyses German economy

Political events and crises such as the war in Ukraine, the Covid pandemic or the Brexit continuously cause financial challenges for companies, such as cost and interest rate increases, which lead to uncertainties in corporate planning. This “perfect storm” to which companies and investors alike have been exposed for years, leads to changes in the financial markets.

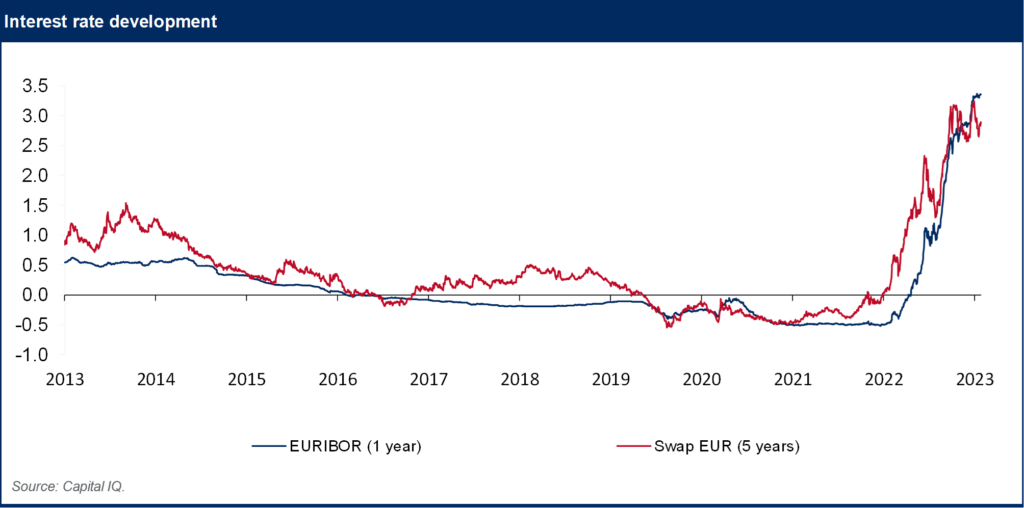

Interest rate hikes and additional regulations by capital providers are influencing the supply and demand of financing and investment options worldwide. Although the expected winter recession in Germany failed to materialize and the ifo business climate index recorded its fourth consecutive increase, economists warn against overly optimistic expectations, because despite the absence of a worst-case scenario, interest rate cuts are unlikely in the medium term.

Latest turbulences surrounding Silicon Valley Bank and the Swiss National Bank’s support for Credit Suisse show that the economic environment remains unstable.

2. Reluctance on the part of capital providers

The need for crises related reforms in the German economy poses risks for companies to maintain their current competitive position and at the same time opens new business opportunities. The resulting strategy considerations and implementations require additional capital, while at the same time the conditions of the financial markets are more restrictive:

- Banks review and tighten their lending conditions and show limited appetite to acquire new customers and expand credit

→30% to 40% of companies are dissatisfied with the commitment of their banks

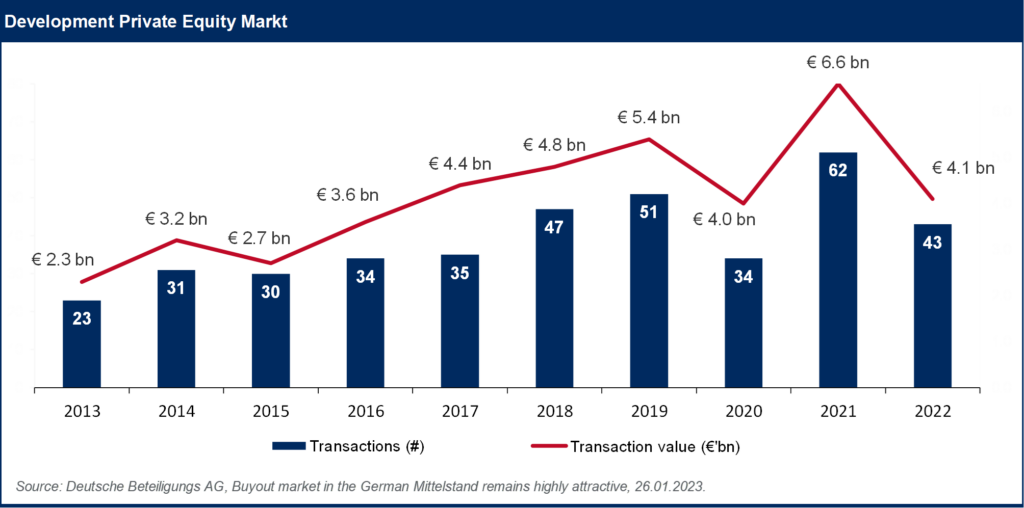

- Private equity companies reduced investments both in terms of deal number and transaction value in 2022 compared to the previous year

- As a result of the events surrounding Silicon Valley Bank and Credit Suisse, central banks will pay even closer attention to banks’ equity capital requirements, which in turn will lead to more restrictive lending policies

The historically strong buyer’s market with simultaneously extremely high liquidity from capital markets is increasingly transforming into a seller’s market in favor of the capital providers due to these trends.

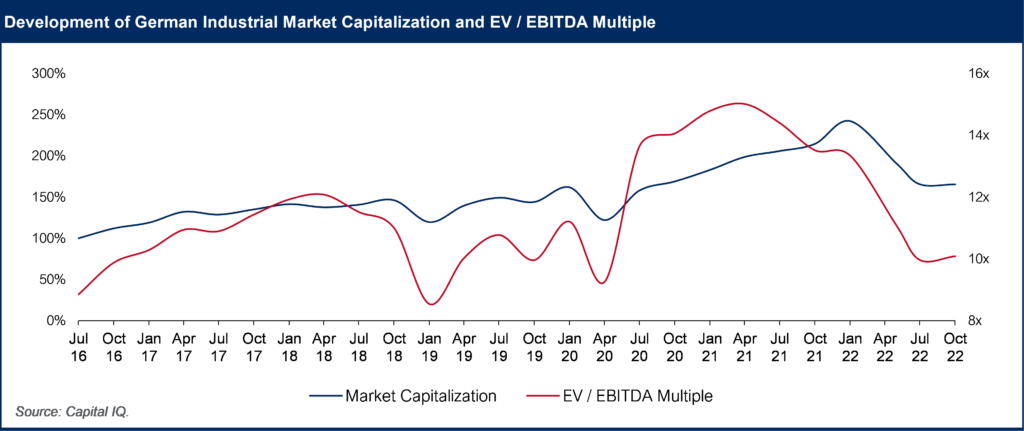

The rise of geopolitical risks, commercial uncertainty and cautious capital markets are reflected in weaker corporate forecasts, which lead to a decrease in corporate valuations (multiples) and poorer corporate ratings. In the capital markets, interest rates have reached levels not seen for more than one decade based on a combination of rising central bank rates and higher risk premiums for corporate loans.

SMEs find themselves in a sandwich position between growing funding requirements and tougher credit markets. Therefore, it is difficult for SMEs to obtain financing on attractive terms under the given conditions, so that the following problems arise:

- High capital requirements to implement strategy and maintain market position (including expansion, innovation, business orientation)

- Lower cash flow generation due to higher capital commitment, especially in working capital, and declining profitability due to rising costs

- Continuous liquidity shortage and increasing (re-)financing requirements

- Short-term, restrictive, and costly financing offers

3. Alternative financing options

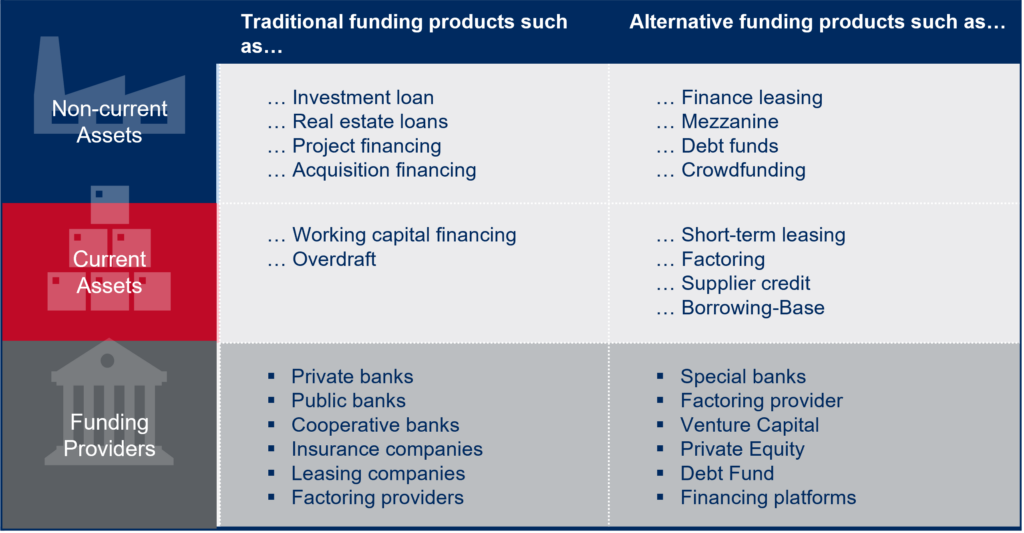

Companies with weaker ratings are increasingly rejected by risk-averse capital providers, which is why providers of alternative forms of financing are gaining importance and popularity.

These can serve companies that are ignored by traditional capital providers (such as banks) due to their risk profile. New market participants often offer additional advantages compared to standard bank loans, such as more flexible and more custom-fit terms of financing (especially with regard to longer maturities and bullet repayment requirements).

With increasingly competitive offers by alternative lenders, a trend towards more diversified financing structures develops. This applies to both long-term and short-term financing.

However, new, and sometimes complex financing products increase the risk of making wrong and, above all, costly decisions and demonstrate the need for a well-thought-out financing strategy as well as a professional dialogue between companies and capital providers.

Excellent financing advice requires deep insights into the national and international capital markets. Our experienced advisors at Capitalmind Investec help structure the financing strategy and its subsequent implementation. Through our extensive network and access to banks, alternative lenders, loan, mezzanine, and equity funds, we find the most suitable capital providers at the best possible conditions.