- Home

- News & Insights

- Importance of sustainability aspects in M&A transactions

Importance of sustainability aspects in M&A transactions

Thorsten Gladiator, Managing Partner Capitalmind Investec: As corporate finance advisors, we see the importance of ESG in general and sustainability aspects in particular in almost every transaction, both in M&A situations and in financing mandates.

Equity and debt investors place a strong focus on ESG compliant investments in the interest of their financiers and / or due to investment criteria that are binding for them.

For business sellers as well as CFOs, this has pricing and process consequences:

- A clearly defined and documented ESG strategy creates confidence among investors and the company’s other stakeholders

- The same applies to the (early) implementation of legal requirements for sustainability reporting (CSRD)

- A focus on sustainability aspects provides positive differentiation features compared to competitors and can thus have a value-creating effect

- The lack of a corresponding strategy can lead to price discounts in the valuation as well as higher financing costs

- In the due diligence phase of a transaction, lack of ESG information leads to prolonged processes, higher management burden and the withdrawal of investors with clearly defined ESG investment criteria

The following article from AIM – Advice in Motion highlights the various aspects for medium-sized companies and shows examples of successful ESG strategies.

Opportunities and challenges of sustainability for smaller and medium-sized enterprises

The sustainability performance of a company today is the decisive factor for its competitiveness tomorrow. In this context, medium-sized companies in Germany in particular are faced with tasks whose extent has not yet been fully recognized in many cases and which involve major challenges in terms of resources, time and expertise.

Even though sustainability is a ubiquitous and much-discussed topic that is omnipresent both in the media and in public debate, it is by no means a new issue. Rather, sustainability has a long and exciting history that spans centuries and has been shaped by various actors and concepts.

Where do the roots of sustainability lie?

As far back as the Middle Ages, the moral ideal of the honorable merchant played a decisive role in promoting sustainable principles. Many a family entrepreneur rightly sees himself or herself in the tradition of the honorable merchant and aligns his or her business conduct with principles such as honesty, responsibility and sustainability.

In the 18th century, the Saxon chief miner Carl von Carlowitz coined the term sustainability in his work “Sylvicultura Oeconomica.” He introduced the idea that forest resources should be managed sustainably by cutting only as much wood as can naturally grow back. What was interesting about Carlowitz’s concept of sustainability was that sustained yield was precisely not antithetical to sustainability. Rather, forestry yield acted as the cornerstone for this oft-cited source of the concept of sustainability. The mining area of the Erzgebirge was simply dependent on the sustainable use of wood for construction, mining and smelting purposes.

Another significant milestone in the development of sustainability was the Brundtland Report, published in 1987 under the title “Our Common Future”. The report defined sustainable development as “development that meets the needs of the present without compromising the ability of future generations to meet their own needs.” Here, sustainability clearly went beyond a purely economic consideration. The report emphasized the need to integrate economic, social and environmental aspects to create a sustainable future.

Since then, the understanding of sustainability has evolved to encompass a variety of dimensions. One key concept is ESG (environmental, social, governance) criteria, which encompass environmental, social and governance-related factors. Differentiation of individual sustainable development goals is achieved through the United Nations Sustainable Development Goals (SDGs), which were adopted in 2015. The SDGs include 17 global goals to promote sustainable development at the economic, social and environmental levels by 2030. These goals range from poverty reduction, health, education and gender equality to renewable energy and sustainable cities.

The SDGs are an excellent framework for linking the principle of sustainability with economic, ecological and social development and provide a suitable orientation framework for a company’s sustainability strategy:

- SDGs as guidelines for sustainable management

- Alignment of products and services with the SDGs

- Business activities can contribute directly to achieving the SDGs

Nowadays, at the current edge of development trends around sustainability, so to speak, ESG expression is thus considered a leitmotif and fundamental approach for responsible and sustainable development. It is about combining economic, social and ecological aspects in order to create a world worth living in for present and future generations.

The individual SDGs are suitable targets for integrating ESG into corporate strategies, as they are more concrete and easier to measure using indicators than the more fundamental ESG concept.

Importance of the midmarket

As the backbone of the economy, the SME sector comprises a large number of companies that operate both regionally and internationally. It is of great importance for economic performance and employment in the country. Around 2.5 million companies in Germany belong to the Mittelstand, in the definition of a small and medium-sized enterprise (SME). These range from microenterprises to medium-sized companies with up to 250 employees, which generate around one-third of total sales for Germany and employ more than half of all employees.

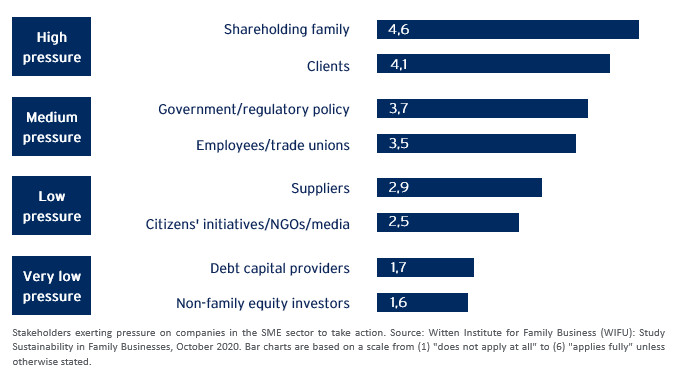

Expectations around an ESG expression of the SME business model arise in a wide variety of internal and external stakeholder groups. Typical stakeholders include shareholder families, employees, customers and suppliers, financiers (EC and FC), NGOs and the media, and to an increasing extent regulatory policy.

The reasons for which companies address ESG requirements also vary. The most common motives include:

- The assumption of ecological and social-societal responsibility,

- Ethical reasons and intrinsic motivation,

- Requirements of customers and employees,

- Cost reduction and expectation of increasing sales,

- Requirements of capital providers,

- And last but not least, the increasing regulatory requirements.

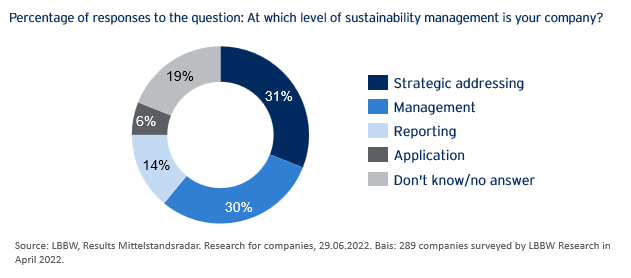

The majority of companies are in the early stages of sustainability management.

Pressure to act and status quo around ESG in SMEs

The pressure to develop and implement ESG strategies is immense and relevant stakeholders are demanding this. In addition to opportunities of an ESG orientation such as cost reduction, successful positioning of the company, revenue and profitability advantages, there are clear business risks of a lack of consideration of sustainability requirements up to the withdrawal of the “license to operate” (violation of regulatory requirements, exclusion from supply chains, lack of financing or perspective withdrawal of insurance coverage).

If, against this background, surveys come to the conclusion that, despite pressure to act and explicit expectations of the relevant stakeholders, only around half of the companies in the SME sector have developed and implemented ESG strategies, the question arises as to why.

A ´decisive factor is the lack of time and resources in many SMEs to deal with the challenges and requirements of sustainability. Time is traditionally a scarce commodity, especially in owner-managed companies. Teams and specialists for ESG strategies and sustainability cannot simply be plucked out of the ground: the market for ESG specialists is empty and salary expectations are correspondingly high.

Support from external consultants is the obvious choice, but here, too, capacities are stretched and for many a large consulting firm it is obvious and more lucrative to advise the large DAX companies with entire teams of consultants before they delve into the peculiarities of the business model of a geographically decentralized SME.

AIM – Advice in Motion GmbH

This is where AIM, as an independent sustainability consultancy and partner in the Capitalmind Investec network, can provide effective support. AIM thinks and speaks medium-sized. Their clients include medium-sized companies from a wide range of industries in Germany, France, Portugal, Luxembourg and Switzerland. AIM supports with:

- Creation, coordination and implementation of ESG strategies in medium-sized companies,

- Preparation for mandatory sustainability reporting (CSRD),

- Directive-compliant calculation of the carbon footprint of companies (CCF) and products (PC),

- Preparation of climate strategies, derivation of targets and measures from the climate footprint,

- Communication around ESG and climate protection: avoidance of reputation risks.

Examples of successful ESG implementation in medium-sized companies:

I. Initial situation: Sustainability requirements for a medium-sized company in the wood industry in Germany with around 1,200 employees. In addition to the intrinsic motivation of the shareholders, a major impetus for action arose from the initiative of the industry association, which demands the implementation of climate protection measures for all member companies. Another impetus for action was for the company, as a supplier in the value chain of a large trading house, to support its ambition (climate protection and other social goals throughout the supply chain). AIM supported the development of a climate strategy, the calculation of the corporate carbon footprint and the compensation of unavoidable emissions in order to achieve climate neutrality.

II. Initial situation: market positioning of a 5-star resort hotel in Provence with its own vineyard. A key impetus for action was to reconcile a luxury resort with sustainability requirements and climate change mitigation measures. AIM developed an ESG strategy for the resort. This was based on a selection of sustainable development goals (SDGs) to which the resort can contribute. Corresponding measures were defined and implemented. At the same time, climate neutrality was achieved for the resort by offsetting unavoidable emissions. (AIM has implemented a comparable project with a resort in Portugal, which has since been nominated for the Sustainability Award of the Portuguese Tourism Association).

III. Initial situation: product positioning for a manufacturer of high-quality competition racing bikes from Switzerland. The company wants to make competitive sports compatible with sustainability and climate protection in particular. In order to provide buyers and users of the competition bike with an assessment of the carbon footprint of the racing bike product, AIM calculated the product-related carbon footprint for the bike, taking into account all phases of the life cycle of the racing bike, from cradle to grave.

IV. Initial situation: A medium-sized holding company with around 1000 employees in Germany will be subject to mandatory sustainability reporting in accordance with CSRD for the first time from the calendar year 2024. The extended reporting affects around 15,000 companies in Germany. The company’s sustainability performance will be considered from two perspectives: the impact of sustainability aspects on the corporate business model and the impact of the company’s activities on the environment and stakeholders. At the same time, the company aims to create a comprehensive ESG strategy that brings together all the actions taken to date to support sustainability goals. AIM has worked with the company to develop an ESG strategy that is aligned and parameterized with metrics to best prepare for upcoming sustainability reporting.

The development of company specific ESG and climate strategies and the requirements associated with the expansion of sustainability reporting pose major challenges for entrepreneurs in the SME sector. We support your company effectively in the sustainable transformation to ensure together with you the future and the competitiveness of your company for you and future generations.

Author: Andreas Kuschmann, Founding Partner AIM – Advice in Motion GmbH.