- Home

- News & Insights

- Industrial Tech Valuations – Part 1

Industrial Tech Valuations – Part 1

Industrial Tech Overview

Industrial Tech ratings significantly higher than before COVID-19

Industrial Tech valuations multiples currently strong at 16.1x EBITDA. 22% (!) higher than pre-COVID-19 January 2020 (13.5x)

Market capitalization increased by 10.5% – the remaining effect of lower EBITDA expectations. Impact of changed net indebtedness not quantifiable due to database.

Absolute EBITDAs forecasts 8% lower than 2019. Resulting from 16% lower revenue expectations and an increased (!)margins to 13% (12% in 2019).

Overall, the sector outperforms (market cap) the #DAX30 by 16%, which has lost 5% since the beginning of the year.

Changes in debt levels for 2020 can only be discussed after financial statements are published. It is very likely that most companies have drawn credit lines to secure liquidity – but it remains unclear which companies will need them to settle COVID-19 claims.

Valuation drivers:

Automation and digitization trend confirmed: Software vendors, automation specialists and integrated players benefit, while traditional mechanical engineering and engineering services (without proprietary products) lose out.

Market capitalization per sub-segment (total +11%):

+20% Industrial Software

+7% automation

+5% Integrated groups

-5% mechanical engineering

-13% engineering services

EBITDA in comparison to 2019 (total -10%):

+8% Integrated Groups

+7% Industrial Software

-10% engineering services

-21% Mechanical engineering

-29% Automation

Automation & Control (Robot/Intelligent Motion)

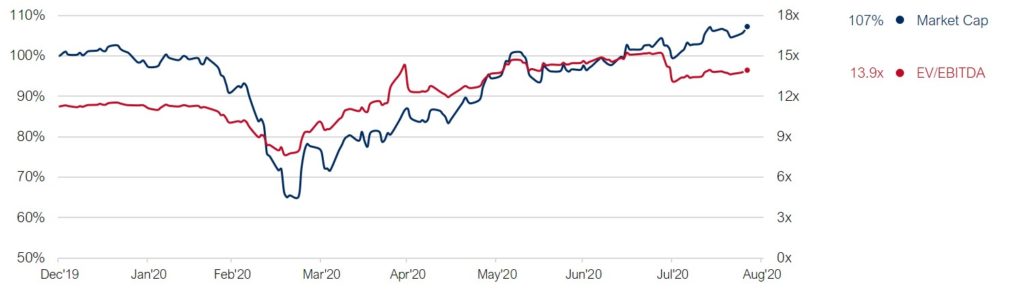

Automation companies rated significantly higher than before COVID-19

Automation companies today are at 13.9x EBITDA, 24% higher than pre-COVID-19.

The market capitalization has increased by 7% in the same period, the Capitalmind Investec Industrial Tech Index total +10.5% while the #DAX30 has fallen by -5%.

Absolute EBITDA guidance 28% lower than 2019 results, while revenues are down 9% and margins remain at 15%.

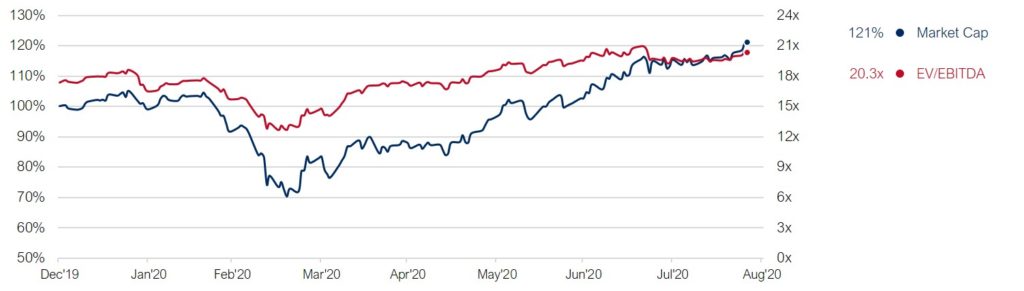

Industrial software companies highly valued, strong margin and EBITDA forecasts

Industrial software multiples are at 20x EBITDA, 17% higher than before COVID-19.

The sub-sector market capitalization performance is 10% points stronger than the Capitalmind Investec Industrial Tech Index (+21% vs. +11%) and +26% than #DAX30 (21% vs. -5%).

Absolute EBITDA forecasts are 43% higher (!) than 2019 results – driven by 3% higher revenues and 11% (!) higher margins (2020 forecast 31%).

Capitalmind Investec & Industrial Technology

The Capitalmind Investec Industrial Tech Index tracks real-time developments in the sector, including valuations, growth, profitability, etc. In addition, resulting trends and transactions. Sub-sectors considered are Automation & Control (Robot/Intelligent Motion), Mechanical Engineering, Industrial Software, Engineering Services & Integrated Corporations.

Interested in finding out more? About valuations, buyers or current sales projects in the market?

Let’s talk over a coffee – in the office or via video.

Visit us on our page: https://capitalmind.com/industrials/