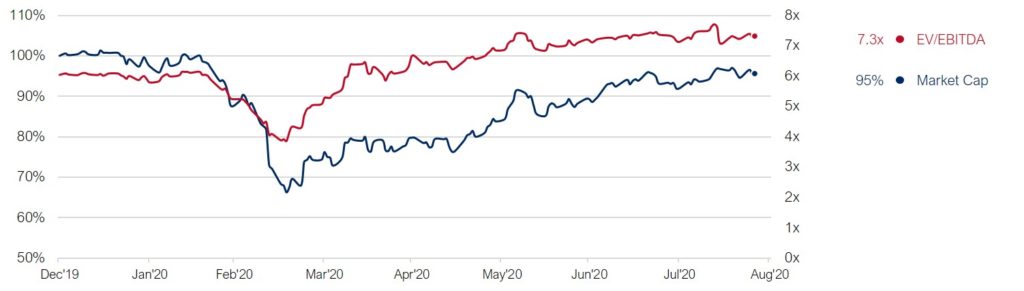

Mechanical engineering valuations rise despite COVID-19

Engineering companies currently valued at 7.3x EBITDA, 21% (!) higher than before COVID-19.

Market capitalizations of the sub-sector have fallen by 5%, while the entire Capitalmind Investec Industrial Tech Index rose by 10.5%. The performance thus follows the #DAX30 -5%.

Absolute EBITDA expectations are 21% below the 2019 results. Sales are down 19% and margins to 7% (8% in 2019).

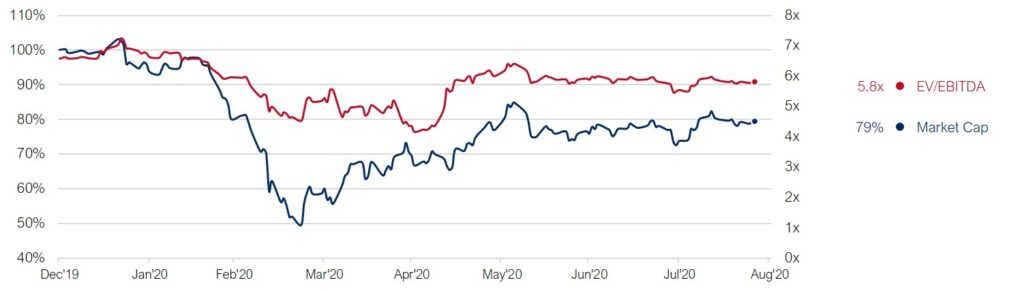

Engineering services lose valuation – EBITDA & turnover expectations collapse

Engineering service providers are currently valued at a 5.8x EBITDA, 12% lower than before COVID-19.

Since January 2020, sub-sector market capitalizations have lost 21%, while the total Capitalmind Investec Industrial Tech Index has risen 10.5% and the #DAX30 has lost 5%.

Absolute EBITDA forecasts are 9% below 2019 results, while revenues are down 26% from 2019 and margins remain stable at 6%.

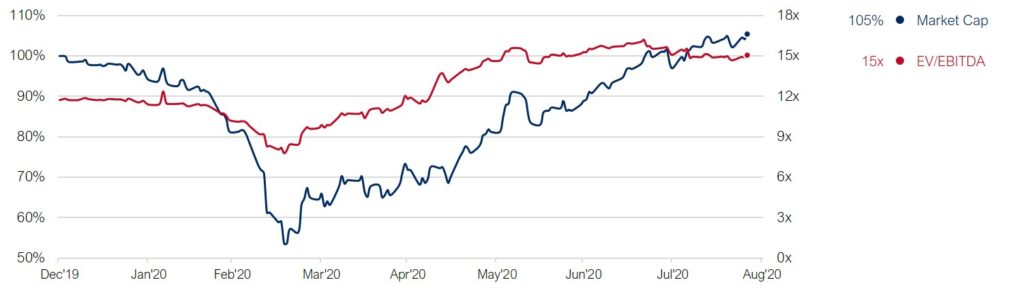

Integrated groups rated significantly higher than before COVID-19

Integrated groups are currently valued at a 15x EBITDA, 28% higher than before COVID-19.

The market capitalization of the sub-sector has increased by 5.3% since January 2020, while the Capitalmind Investec Industrial Technology Index has risen by 10.5% and the #DAX30 has lost 5%.

Absolute EBITDA forecasts 17% lower than 2019 results, while revenues are down 27% from 2019 and margins remain at 11%.

Capitalmind Investec & Industrial Technology

The Capitalmind Investec Industrial Tech Index tracks real-time developments in the sector, including valuations, growth, profitability, etc. In addition, resulting trends and transactions. Sub-sectors considered are Automation & Control (Robot/Intelligent Motion), Mechanical Engineering, Industrial Software, Engineering Services & Integrated Groups.

Interested in finding out more? About valuations, buyers or current sales projects in the market?

Let’s talk over a coffee – in the office or via video.

Visit us on our page: https://capitalmind.com/industrials/