There has been considerable M&A activity in the IT services sector over the last 5 years. Key buyers in the industry are the big IT services companies such as Accenture, CGI Group, Capgemini, KPMG and Atos. Private Equity is also showing more activity in the market, indicating future consolidation and strong expected growth. A selection of Private Equity players active in the Dutch IT Services market is Waterland (Ad Ultima Group), Holland Capital (Wortell), Egeria (Ilionx) and The Carlyle Group (HSO). These Private Equity companies are pursuing a Buy & Build strategy within a specific Internet Technology stack (such as Microsoft Dynamics 365 & Azure).

The US and Europe headquarter most of the acquired target companies

The sector is very active, with an average of almost 800 transactions per year in the last five years (2014-2019). The absolute peak took place in 2018 with 932 transactions worldwide. Buyers acquired 1,899 European headquarted targets during these five years. A significant number of these transactions involved a target headquartered in The Netherlands and neighboring countries.

The US is the global market leader in buying IT services companies (1,835 transactions where the US headquarter the buyer). The UK (466 transactions), France (312), Japan (269) and Germany (191) closely follow the US. As a buyer, the Netherlands is on the tenth place with 98 transactions.

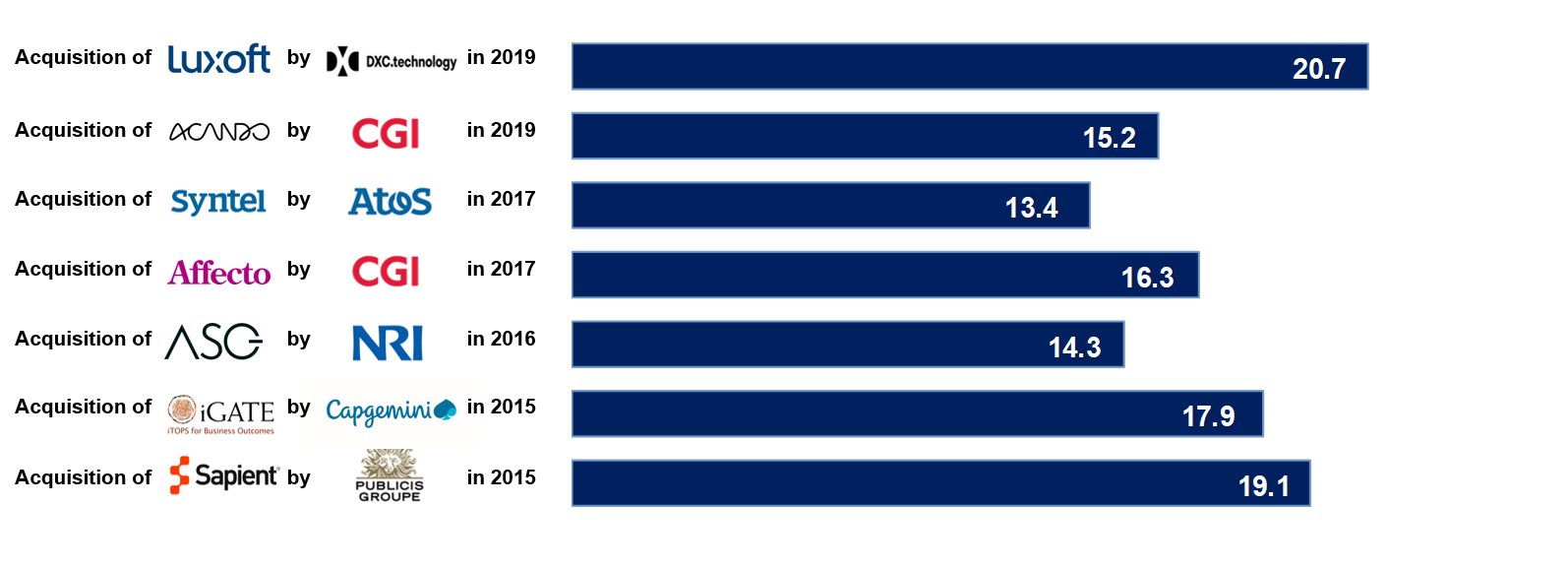

High (EBITDA) multiples for large companies

As can be seen in the figure below EBITDA multiples are remarkably high for companies with significant size (> € 100m enterprise value). A noticeable transaction in the last years was the acquisition of Luxoft (CH) which provides digital transformation services by IT services company DMX Technology Company (USA) for almost $ 2bn (EBITDA multiple of 20.7!)

Domestic transactions are dominant in Europe

The majority of the deals in the European landscape are domestic. However, what can be noticed is that the UK (82%) and France (89%) have significantly more domestic transactions than other countries in Europe. Besides strategic buyers, an accelerated M&A activity can be noticed from Private Equity.

* Analysis is based on Capitalmind Investec’s proprietary database, covering over 5,500 IT services transactions from 2014 till 2019. No representation or warranty, express or implied, is made as to the accuracy, reasonableness or completeness of the database.