- Home

- News & Insights

- So, they made an offer. Now what?

So, they made an offer. Now what?

Both financial and strategic investors increasingly submit purchase offers directly to company owners. They are often completely unprepared for such an offer. Buyers try to take advantage of this surprise effect.

Both interested parties from the private equity segment and companies themselves are now once again directly approaching company owners or making indicative offers for the purchase of privately owned companies to an extent rarely seen. Due to the ongoing low interest rate policy of central banks, high valuations, attractive growth prospects and high liquidity available for investments, private equity companies are under considerable investment pressure and have therefore significantly increased their direct investment efforts. Similarly, large companies are seeking growth through acquisitions to gain access to technologies and user end markets or to support their record high share prices. Both types of buyers seek to avoid highly competitive and structured transaction processes led by M&A advisors. From the buyer’s point of view, this can optimise the transaction duration and the purchase price – to the detriment of the seller.

Optimise sale price

Recently, we were approached by a business owner who had received an unsolicited offer to buy his company from a larger industrial partner. This original offer was around EUR 28 million. The entrepreneur sought advice because he was unable to assess the offer due to the lack of an accurate idea of the value of his company. At the same time, no preparations had been made for a possible sales process. Although there was a certain curiosity about a sale in terms of long-term succession planning, the topic of a company sale was not (yet) on the agenda due to positive business prospects.

The company had a current EBITDA of around EUR 4 million, attractive margins, a good reputation, and long-standing relationships with an international customer base. As with many SMEs, there was a noticeable concentration on certain customer sectors in this case.

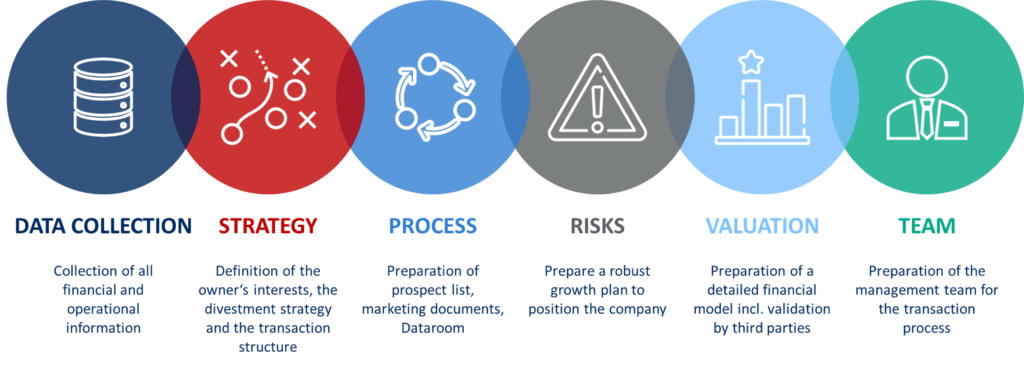

We were able to argue and convince the entrepreneur that a higher sales price usually could be achieved through a thorough preparation of information and documents as well as a competitive sales process. Special attention was paid to the formulation of an attractive “equity story”, which was derived from the positioning of the company, its unique selling propositions, and its growth potential. Equally important was a review and preparation of the financial history as well as the short- and medium-term corporate planning, ideally consisting of an integrated P&L, balance sheet and cash flow planning.

After preparing the sales documents, a multi-stage sales process was initiated and structured in which both potential strategic buyers and selected financial investors such as private equity companies and family offices were approached. Relevant company information was first made available to interested parties by means of a teaser and investment memorandum and, in a later step, via an electronic data room. The confidentiality and sensitivity of certain information was always taken into account through the gradual disclosure, which was adapted to the stage of the process or negotiations.

The company was ultimately sold to the original bidder for more than EUR 36 million. This represents a significant improvement over the initial bid – without any material change in the operational or financial situation.

Don’t get rattled

Buyers try to take advantage of the element of surprise by proactively making offers. Such offers are often not only below the achievable market price, but they address companies and owners unprepared. A professionally structured divestment process can increase the probability of success of a transaction and optimise the transaction terms, including the final purchase price, in favor of the seller.

Don’t reveal too much too soon

Sometimes, as advisors, we are only brought into a sales process when talks with the prospective buyer are already underway or – regrettably – deadlocked. By this time, a lot of information has often already been given to the prospective buyer, which tends to weaken the seller’s position. In such a situation, it is important to regain control of the transaction process. By preparing well for the due diligence and by including possible other interested parties in the divestment process, the seller’s negotiating position can be improved. The further process may or may not include the original bidder.

By proceeding in this way, business owners can be sure that they can optimise the valuation as well as better control the contractual arrangements of the final buyer. With a view to a careful preparation and structured implementation of a sale, it is in this respect helpful to involve or cooperate with specialised advisors as early as possible.

Cooperation with “business confidants”

We have been “in the market” since 1999, during which time Capitalmind Investec has built trusting relationships with numerous financial institutions, tax advisors, auditors, and other business confidants. We understand and respect the history of relationships, therefore clear agreements and responsibilities are important to us. As an advisor specialised in corporate transactions and financing, we rely on close cooperation with these players as well, in order to bring together expertise and drive for the benefit of the client.